Effective November 1, 2012, Handbook F-101, Field Accounting Procedures, is revised to increase the emergency one-time expense payment from $500 to $1,000. Such payment must be issued using a no-fee postal money order.

Post Offices™ and postal retail units must follow the hierarchy for preferred payment methods as outlined in Handbook F-101, eBuy2, SmartPay, and PS Form 8230, Authorization for Payment. As a last payment option, categorized as an emergency one-time payment, a no-fee postal money order may be issued.

For subsequent payments, if a vendor is not in eBuy2 and does not accept the SmartPay purchase card, submit the invoice with PS Form 8230 to the Scanning and Imaging Center (SIC).

Handbook F-101, Field Accounting Procedures

* * * * *

19 Payments

* * * * *

19-1 Preferred Payment Methods

19-1.1 Hierarchy

[Revise 19-1.1 by deleting the third paragraph to read as follows:]

The preferred method for paying recurring Postal Service expenses is through electronic funds transfer (EFT).

If EFT payment is not available or practical, field units should use the payment methods listed below in order of priority.

The preferred methods for payment of local purchases are, in preferred order, as follows:

a. eBuy2 — On catalog (EFT).

b. SmartPay purchase card.

c. Invoice payments: PS Form 8230, Authorization for Payment, or PS Form 8232, Payment for Personal Services Contracts, submitted to the Scanning and Imaging Center (SIC), and processed through the Accounts Payable System.

d. Local Payments.

n Cash for an emergency one-time expense, not to exceed $25.

n No-fee money order for an emergency one-time expense, not to exceed $1,000. (POS and eMOVES units use Reason Code 029, One-time Local Purchase.)

Note: Use only one of the above methods to prevent duplication.

* * * * *

19-1.5 Local Payments

[Revise 19-1.5 to read as follows:]

Local payments are limited to invoices of $1,000 or less for a one-time emergency payment to a vendor. For subsequent payments, if a vendor is not in eBuy2 and does not accept the SmartPay purchase card, submit the invoice with PS Form 8230, Authorization for Payment, to the Scanning and Imaging Center (SIC).

Follow these steps for all local payments:

a. Record cash or no-fee money order payments on PS Form 1412. Use the AIC Crosswalk in Appendix A to identify the correct AIC.

n Cash payments may not exceed $25.

n No-fee money orders may not exceed $1,000. Ensure the fee for the no-fee money order is reported in AIC 586; POS and eMOVES units use Reason Code 29.

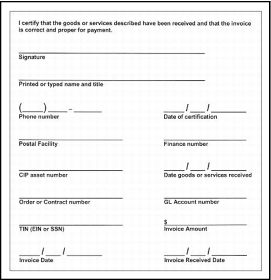

b. To ensure consistency in the invoice certification process, use the following certification stamp format:

c. File the invoice, approved eBuy2 requisition, or PS Form 7381 (if eBuy2 is not available), and proof of payment locally as supporting documentation for the PS Form 1412 entries.

See part 2-4.7 for the separation of duties guidelines.

Payments for services (or a combination of services and supplies), regardless of amount, are 1099-reportable. If 1099-reportable, do the following:

a. Complete PS Form 8231, Vendor Payment 1099 Reporting Form, describing the services, and submit it to the SIC the day that the payment is made.

b. Keep a copy of PS Form 8231 and supporting documentation for 120 days from the end of the month in which the form was submitted to the SIC.

See subchapter 19-6 for additional information.

* * * * *

19-2 Payment Requirements

* * * * *

19-2.3 Manual Invoice Processing

[Revise 19-2.3 to read as follows:]

The preferred methods for purchases and payments are eBuy2 and the SmartPay purchase card.

If the required goods or services are not available through eBuy2, and if the vendor does not accept the SmartPay purchase card, process the invoice manually according to the following table:

If the contract invoice amount is…

|

Follow the procedures specified in the contract or purchase order and…

|

Greater than $10,000 (utilities services only)

|

Complete PS Form 8230 and forward it, with the invoice attached, to the SIC.

|

Less than $10,000 (not to exceed delegated authority)

|

$1,000 or less for a one-time emergency payment to a vendor. For subsequent payments, if a vendor is not in eBuy2 and does not accept the SmartPay purchase card, submit the invoice with PS Form 8230, Authorization for Payment, to the Scanning and Imaging Center (SIC).

|

Issue a no-fee money order (not to exceed $1,000) or

Issue cash disbursement (not to exceed $25).

|

* * * * *

19-3 Documenting Payments

[Revise title and introductory text of 19-3.1 to read as follows:]

19-3.1 Invoices for $1,000 or Less for One-Time Emergency Payments

PRUs may make one-time emergency payments with cash (not to exceed $25) or a no-fee money order (not to exceed $1,000). The procedure for reporting such payments is as follows:

* * * * *

19-6 1099-Reportable Vendor Payments

[Revise 19-6 to read as follows:]

Federal law requires reporting of payments that are made locally for services. Field unit employees must report local payments for services as follows:

a. Complete PS Form 8231 whenever a payment is made for a service that is 1099-reportable.

b. Forward the completed PS Form 8231 immediately to the SIC.

In emergency situations, PRUs may issue disbursements with a no-fee money order or cash, but are limited as follows:

a. The maximum limit for a no-fee money order is $1,000 for a one-time emergency payment. Ensure the fee for the no-fee money order is reported in AIC 586; POS and eMOVES units use Reason Code 29.

b. The maximum limit for a cash disbursement is $25.

The following table identifies the types of payments that field units must report and do not report.

If an invoice contains an itemization for services and supplies, report only the services.

The total invoice is reportable if the services and supplies are not itemized.

* * * * *

19-7 Quick Reference Payment Tables

19-7.1 Payment Process Table

The following table describes how to process different types of payments:

[Revise the table in 19-7.1 to read as follows:]

Type of Payment

|

Form

|

Process

|

Contractual payments

|

None

|

a. Certify contract invoices using the certification stamp.

b. Submit contract invoices to Accounting Services, Contractual Payables Branch.

|

Credit invoices (if originally paid using PS Form 8230)

|

PS Form 8230

|

a. Check credit box.

b. Submit PS Form 8230 and credit invoice to the SIC.

Note: Do not submit credit invoices for recurring utility payments; these credits offset on future invoices.

|

Local payments (invoices of $1,000 or less for one-time emergency payments) to vendors. For subsequent payments, if a vendor is not in eBuy2 and does not accept the SmartPay purchase card, submit the invoice with PS Form 8230, Authorization for Payment, to the Scanning and Imaging Center (SIC).

|

None

|

a. Issue no-fee money order (not to exceed $1,000) or cash (not to exceed $25). If a no-fee money order is issued, report the fee amount in AIC 586; POS and eMOVES units use Reason Code 29.

b. Record payment on PS Form 1412.

c. File invoice and proof of payment locally as supporting documentation.

Note: If invoice is service-related (1099-reportable), submit PS Form 8231 to the SIC.

|

Medical bills — invoices from medical facilities resulting from treatment of job-related injuries and pre-employment testing

|

PS Form 8230

|

a. Submit PS Form 8230 and the original invoice to the SIC.

b. File a copy of PS Form 8230 and the invoice locally for 120 days.

|

OSHA payments

|

See subchapter 20-4.

|

Personal services contractor payments (time sensitive)

|

PS Form 8232

|

a. Mail no later than COB Friday of week 2 of the postal pay period.

b. Submit PS Form 8232 with the original invoice to the SIC.

c. File a copy of PS Form 8232 with the supporting documentation for 120 days.

|

Supplies and services

|

PS Form 8230 (if eBuy2 or SmartPay purchase card is not available)

|

a. Submit PS Form 8230 with the original invoice to the SIC.

b. File a copy of PS Form 8230 and the invoice locally for 120 days.

|

Tort claims

|

PS Form 8230

|

Claims less than $5,000

a. Ensure the expense is applied to GLA 55216000. (Refer to ASM, subchapter 25.)

b. Submit PS Form 8230 to the SIC.

|

PS Form 2198, Accident Report — Tort Claim

|

Claims between $5,000 and $50,000 and denials for claims under $5,000

a. Submit PS Form 2198 and the General Counsel Authorization Letter (If the amount is greater than $5,000) to the following address:

Tort Claim Processing

Accounting Services

PO Box 80471

St. Louis, MO 63180-9471

b. File all supporting documentation locally.

|

None

|

Claims greater than $50,000

Continue submitting claims to the National Tort Claim Center through the district tort claims coordinator.

|

Utilities

|

PS Form 8230

(if eBuy2 or SmartPay purchase card is not available)

|

a. Record the invoice number for a utility invoice using the utility-assigned account number, followed by the invoice month and year (e.g., 123456789DEC06).

b. Submit PS Form 8230 and the original invoice to the SIC.

c. File a copy of PS Form 8230 and the invoice locally for 120 days.

|

For questions about processing payments, call the Accounting Help Desk (AHD) at 866-974-2733.

For more information on where to send forms, go to http://blue.usps.gov/accounting/_doc/Forms_for_Payment.doc.

19-7.2 Commonly Used General Ledger Account Numbers for PS Form 8230

The following table lists the commonly used GLA numbers appearing on PS Form 8230.

[Revise the table in 19-7.1 to read as follows:]

* * * * *

We will incorporate this revision into the next online update of Handbook F-101, available on the Postal Service™ PolicyNet website:

n Go to http://blue.usps.gov.

n Under “Essential Links” in the left-hand column, click PolicyNet.

n On the PolicyNet page, click Handbooks.

(The direct URL for the Postal Service PolicyNet website is http://blue.usps.gov/cpim.)

— Revenue and Field Accounting, 11-1-12