| page 61 of 73 |

Chapter 3

Financial Highlights

|

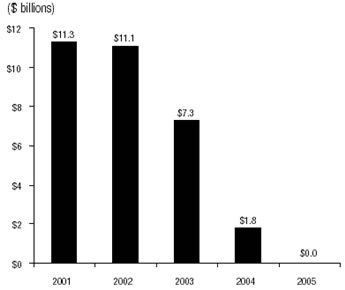

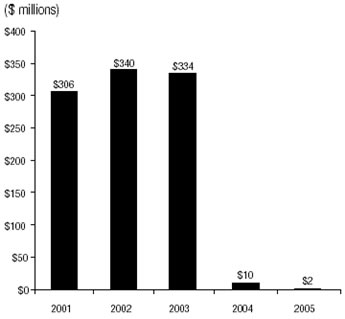

Cash flows in 2005 were marked by two notable occurrences: the workers’ compensation payment exceeded the amount expensed for the year for the first time since 1997; and the payments made for capital investments exceeded depreciation expense for the first time since 2001. It is uncertain whether the workers’ compensation change is an isolated event or the beginning of a new trend. The cash outlays for capital investments are likely to exceed depreciation for the foreseeable future. In 2006 after funding the escrow requirement estimated at $3.1 billion, cash flow from operations will not be sufficient to pay for all planned capital investments. A projected borrowing of at least $1 billion will be needed to make up the shortfall. The Postal Service’s debt levels beyond 2006 will be influenced by the ability to control the level of capital investment and operate at close to break even. Fig 3-3 Debt at Fiscal Year End

*Other interest expense excludes interest on deferred retirement obligations and the 2003 debt repurchase expense.

|

A. INTEREST EARNING INVESTMENTSWhen the Postal Service determines that funds exceed current needs, it invests those funds with the U.S. Treasury’s Bureau of Public Debt, primarily in overnight securities issued by the U.S. Treasury. It favors short-term investments because of its cash flow patterns and to guard investments against exposure to the price risk associated with increases in interest rates.

B. LIQUIDITYPostal Service liquidity is the cash in the Postal Service Fund in the U.S. Treasury and the amount of money that the Postal Service can borrow on short notice if needed. Its note purchase agreement with the Federal Financing Bank, renewed this year, provides for revolving credit lines of $4 billion. These credit lines enable the Postal Service to draw up to $3.4 billion with 2 days’ notice and up to $600 million on the same business day the funds are needed. Under this agreement, the Postal Service can also use a series of other notes with varying provisions to draw upon with 2 days’ notice. The notes provide the flexibility to borrow short-term or long-term, using fixed or floating rate debt, and can be either callable or non-callable. The Postal Service judges that its arrangement with the Federal Financing Bank provides it with adequate tools to effectively manage its interest expense and risk. The amount of funds the Postal Service can borrow is limited by the amount of debt authorized by the Board of Governors and by certain statutory limits on borrowing. Statutorily, total debt outstanding cannot exceed $15 billion; and the net increase in debt for any fiscal year cannot exceed $2 billion for capital purposes and $1 billion to defray operating expenses ($3 billion maximum annual limit). |

||||||||||||||||||||||||