List of Tables and Figures

List of Tables and Figures

E Executive Summary 1

Table

E.1: Mail Received and Sent by Households 1

Table

E.2: Household Mail Volume Received and Sent by Market Served 2

Table

E.3: Advertising by Mail Class 2

Table

E.4: Periodical Type Received 2

Table

E.5: Packages Received and Sent via the U.S. Postal Service 3

1 Chapter

1: Introduction – Volumes & Trends 5

Table

1.1: Total Mail Volume: FY 2010, 2011, and 2012 6

Table

1.2: Total Mail: Revenue, Pieces, and Weight by Shape, FY 2012 7

Table

1.3: Total Mail: Revenue and Weight per Piece by Shape, FY 2012 9

Table

1.4a: Total Domestic Mail Flows 10

Table

1.4b: Total Domestic Mail Flows 10

Table

1.4c: Domestic Mail Flows per Household per Week 10

Table

1.5: Mail Received and Sent by Households 10

Table

1.6: Pieces Received and Sent per Household 11

Table

1.7: Mail Received and Sent by Households 11

2 Chapter

2: Profile of Mail Usage 13

Table

2.1: Mail Volume and Demographics Average Annual Growth, 1981-2012 13

Table

2.2: Characteristics of Higher- and Lower-Mail-Volume Households 15

Table

2.3: Education of Higher- and Lower-Mail-Volume Households 15

Table

2.4: Households by Income and Education 16

Table

2.5: Households by Income and Age 16

Table

2.6: Households by Number of Adults 16

Table

2.7: Households by Size 17

Table

2.8: Households by Type of Internet Access 17

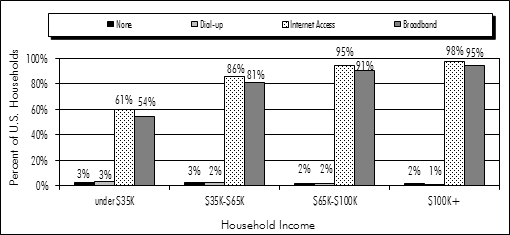

Figure

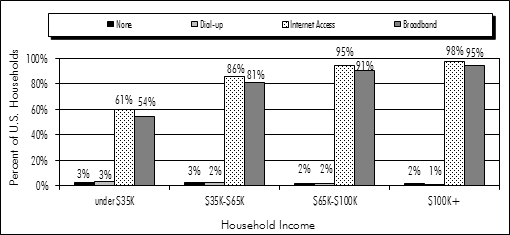

2.1a: Internet Access by Income and Type 17

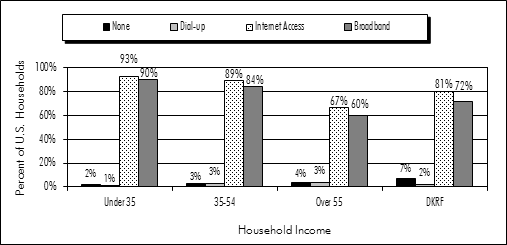

Figure

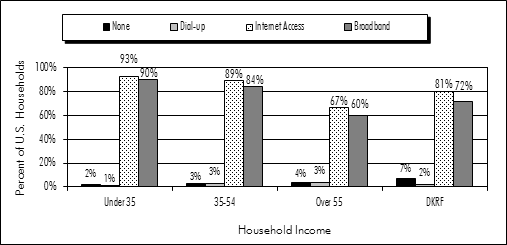

2.1b: Internet Access by Age and Type 18

Figure

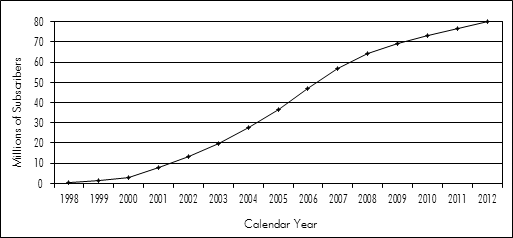

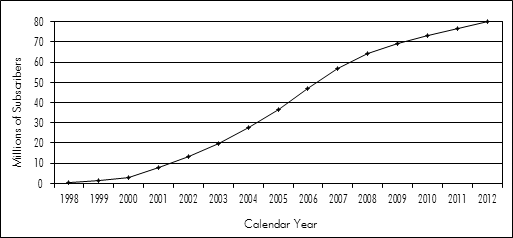

2.2: Broadband Subscribers 18

Figure

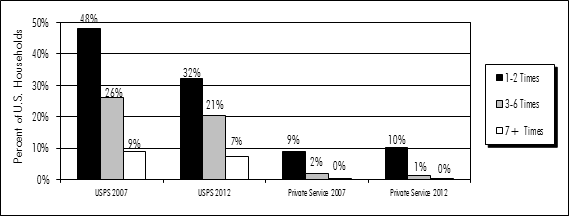

2.3: Household Visits to Post Office in Past Month 19

3 Chapter

3: Correspondence 21

Table

3.1: First-Class Correspondence Mail Sent and Received by Sector 21

Table

3.2: Correspondence Mail Received by Income and Education 22

Table

3.3: Correspondence Mail Sent by Income and Education 22

Table

3.4: Correspondence Mail Received by Income and Age 23

Table

3.5: Correspondence Mail Sent by Income and Age 23

Table

3.6: Correspondence Mail Received and Sent by Household Size 24

Table

3.7: Correspondence Mail Received and Sent by Number of Adults in

Household 24

Table

3.8: Correspondence Mail Received and Sent by Type of Internet

Access 24

Table

3.9: Income and Education by Type of Internet Access 24

Table

3.10: Personal Correspondence Sent and Received 25

Figure

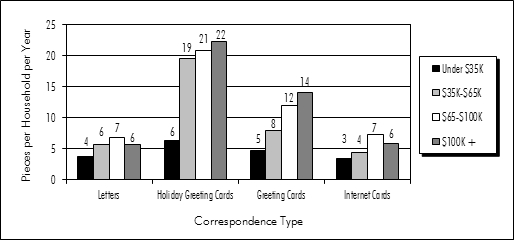

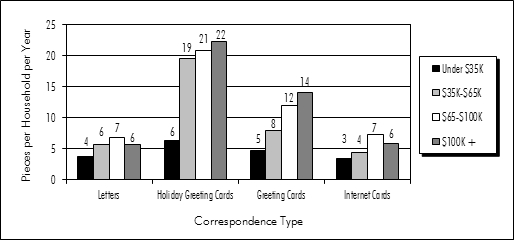

3.1: Personal Correspondence Sent by Income Group 26

Figure

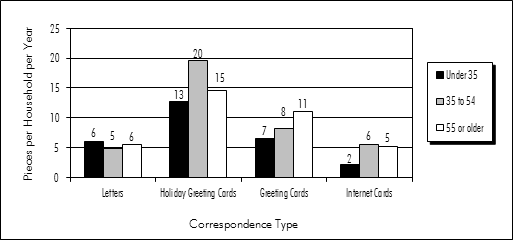

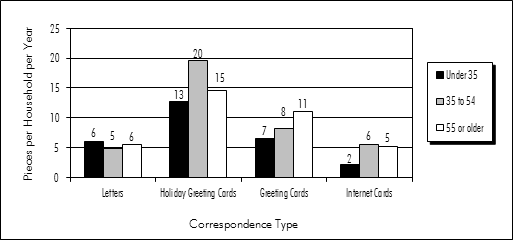

3.2: Personal Correspondence Sent by Age Cohort 26

Figure

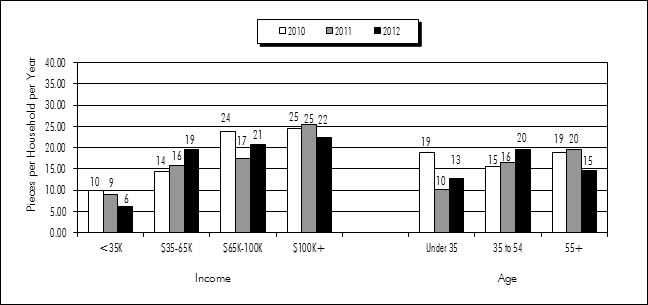

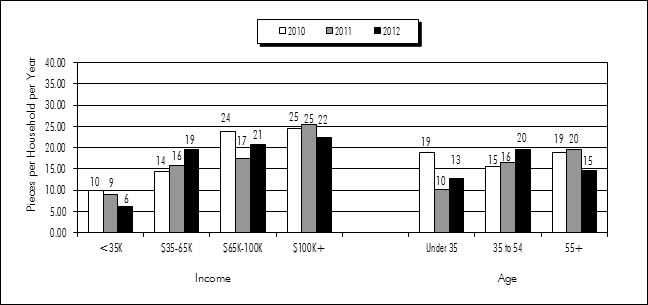

3.3: Holiday Greetings Sent by Age and Income, FY 2010, 2011, and

2012 27

Table

3.11: Personal Correspondence by Type of Internet Access 27

Table

3.12: Business Correspondence Type (Sent and Received) by Sector

(Millions of Pieces) 28

4 Chapter

4: Transactions 29

Table

4.1: Transactions Mail Sent and Received 29

Table

4.1: Transactions Mail Sent and Received (cont.) 30

Table

4.2: Transactions Mail Received by Income and Education 30

Table

4.3: Transactions Mail Sent by Income and Education 31

Table

4.4: Transactions Mail Received by Income and Age 31

Table

4.5: Transactions Mail Sent by Income and Age 31

Table

4.6: Transactions Mail Received and Sent by Household Size 31

Table

4.7: Transactions Mail Received and Sent by Number of Adults in

Household 32

Table

4.8: Transactions Mail Received and Sent by Internet Access 32

Table

4.9: Income and Education by Type of Internet Access 32

Table

4.10: Bill Payment by Method, FY 2010, 2011, and 2012 33

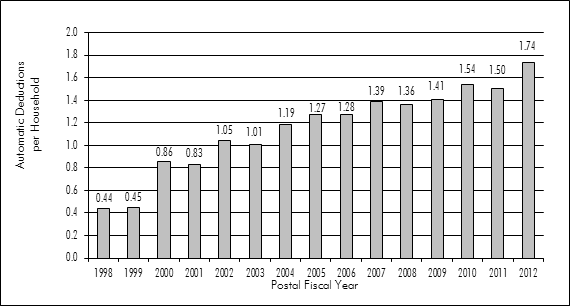

Figure

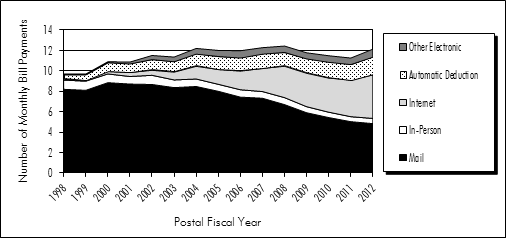

4.1: Monthly Average Household Bill Payment by Method 33

Figure

4.2: Average Monthly Automatic Deductions per Household 34

Table

4.11: Types of Bills Paid by Mail 34

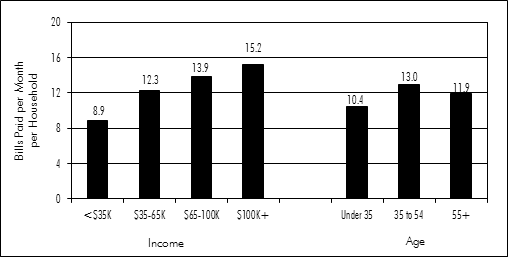

Figure

4.3: Average Bills Paid per Month by Income and Age 35

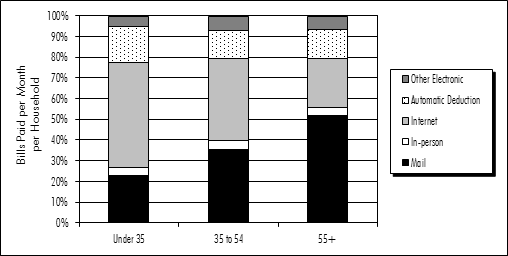

Figure

4.4: Bill Payment Method by Age 35

Table

4.12: Bill

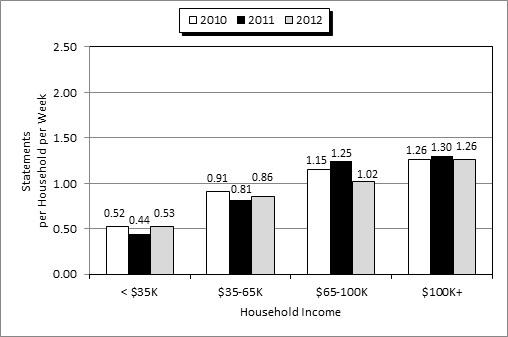

and Statement Volumes by Industry 36

Table

4.13: Average Monthly Bills and Statements Received by Method 37

5 Chapter

5: Advertising Mail 39

Table

5.1: U.S.

Advertising Spending Growth by Medium, 2010-2012 39

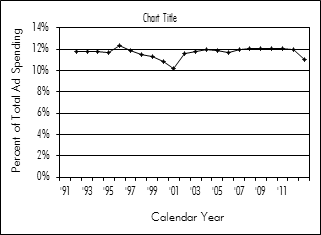

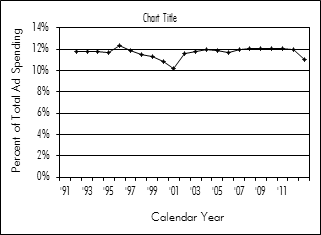

Figure

5.1: Direct

Mail as a Share of Total Advertising, 1991-2012 39

Table

5.2: Advertising

Mail by Mail Classification 40

Table

5.3: Advertising Mail by Mail Classification 41

Table

5.4: Advertising Mail Received by Income and Education 41

Table

5.5: Advertising Mail Received by Income and Age 42

Table

5.6: Advertising Mail Received by Size of Household 42

Table

5.7: Advertising Mail Received by Number of Adults 42

Table

5.8: Advertising Mail Received by Internet Access 43

Table

5.9: Income and Education by Type of Internet Access 43

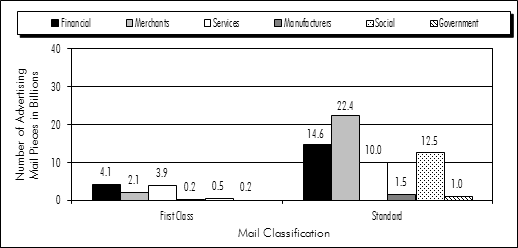

Figure

5.2: Advertising Volumes for First-Class and Standard Mail

Advertising by Sender Type 43

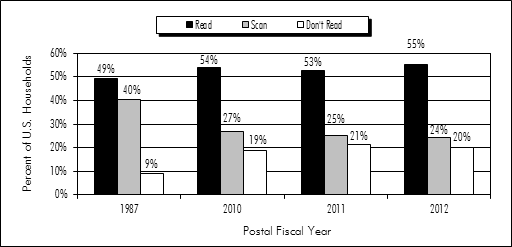

Figure

5.3: Advertising Mail Behavioral Trends, FY 1987, 2010, 2011, and

2012 44

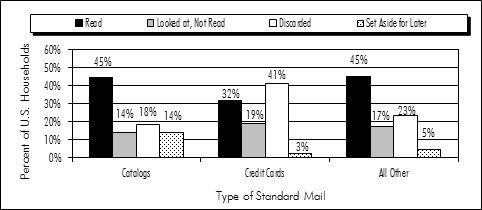

Figure

5.4: Treatment of Standard Mail by Type 44

Figure

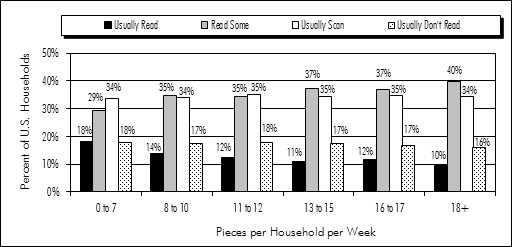

5.5: Treatment of Standard Advertising Mail by Number of Standard

Mail Pieces Received per Week 45

Table

5.10: Intended Response to Advertising Mail by Class 46

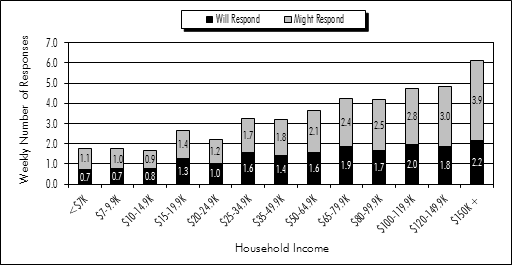

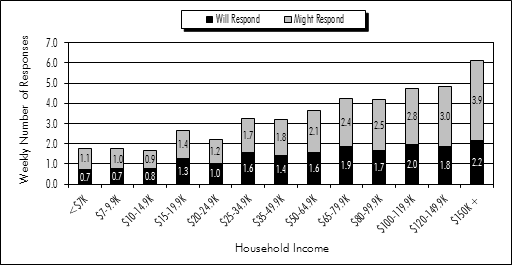

Figure

5.6: Weekly

Number of Intended Responses by Income 46

6 Chapter

6: Periodicals 47

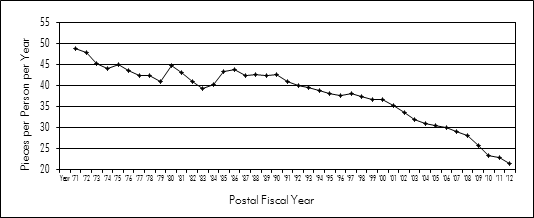

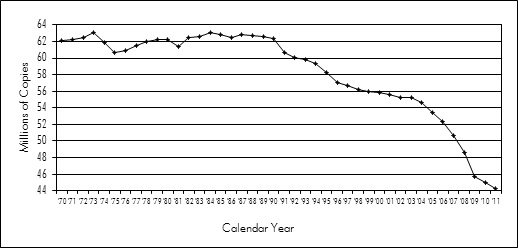

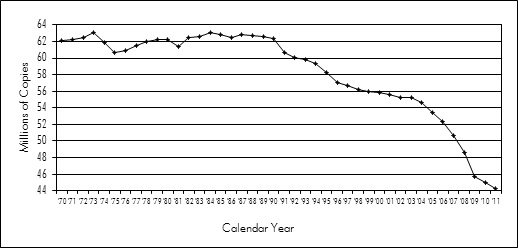

Figure

6.1: Periodicals Mail Volume per Person, 1971-2012 47

Figure

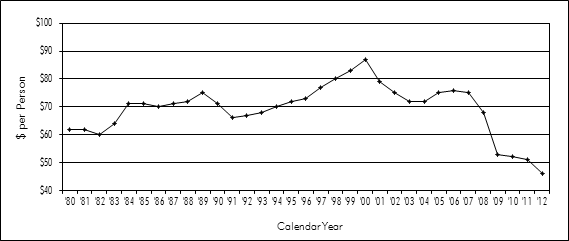

6.2: Real Per-Capita Magazine Advertising Spending, 1980-2012 48

Table

6.1: Periodical Type by Year 49

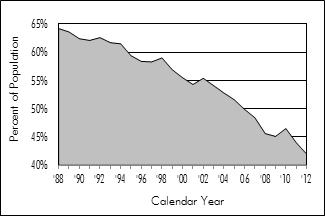

Figure

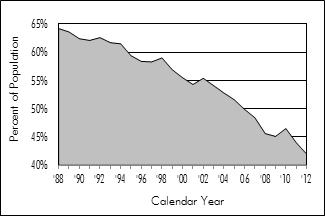

6.3: Newspaper Circulation, 1970-2011* 49

Figure

6.4: Daily Newspaper Readership, 1987-2012 50

Table

6.2: Periodicals by Income and Education 50

Table

6.3: Periodicals by Income and Age 51

Table

6.4: Periodicals by Size of Household 51

Table

6.5: Periodicals by Number of Adults in Household 51

Table

6.6: Periodicals by Type of Internet Access 51

Table

6.7: Income and Education by Type of Internet Access 51

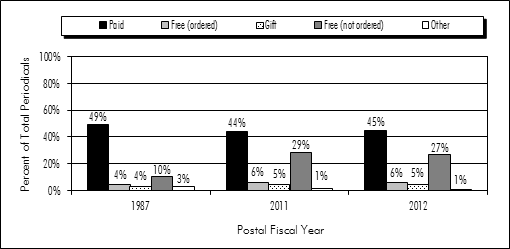

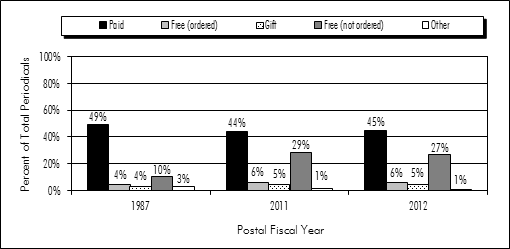

Figure

6.5: Subscription Type by Year 52

Table

6.8: Periodicals by Sender Type 52

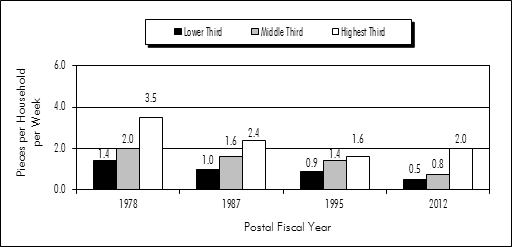

Figure

6.6: Number of Periodicals Received per Week by Households by

Income Group 53

7 Chapter

7: Packages 55

Table

7.1: Total Package Market Volume Growth 56

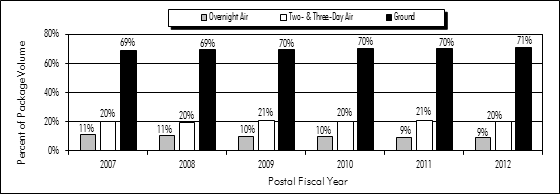

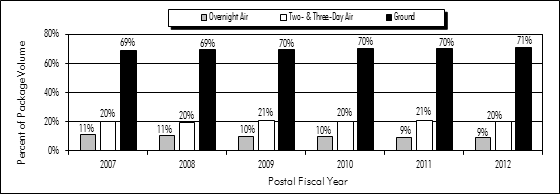

Figure

7.1: Package Delivery Market Segment Share 56

Table

7.2: Postal Service Sent and Received Packages, FY 2010, 2011, and

2012 58

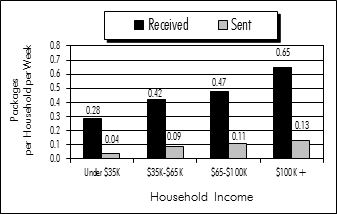

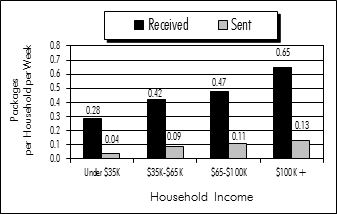

Figure

7.2: Postal Service Sent and Received Packages by Household Income 59

Table

7.3: Postal Service Received Packages by Income and Age 59

Table

7.4: Postal Service Sent Packages by Income and Age 59

Table

7.5: Postal Service Received Packages by Income and Education 60

Table

7.6: Postal Service Sent Packages by Income and Education 60

Table

7.7: Postal Service Received and Sent Packages by Size of

Household 61

Table

7.8: Postal Service Received and Sent Packages by Number of Adults

in Household 61

Table

7.9: Received and Sent Packages by Household Internet Access 61

Table

7.10: Income and Education by Type of Internet Access 61

Table

7.11: Contents of Postal Service Sent and Received Packages 62

This report documents the findings of the United States

Postal Service’s Household Diary Study (HDS) for Fiscal Year (FY) 2012. The

three main study purposes are to:

·

Measure the mail sent and received by U.S. households,

·

Provide a means to track household mail trends over time, and

·

Make comparisons of mail use between different types of households.

The report examines these trends

in the context of changes and developments in the wider markets for

communications and package delivery.

Background

The Household Diary Study

survey, fielded continuously since 1987, aims to collect information on household

use of the mail and how that use changes over time. The survey collects

household information on demographics, lifestyle, attitudes toward mail and

advertising, bill payment behavior, and use of the Internet and other

information technologies.

The FY 2012 report covers

Government Fiscal Year 2012, with comparisons to 2010, 2011, and other years,

as appropriate.

The Household Diary Study

collects information on household mail use and provides

a look at how that use changes over time.

Overview

In 2012, U.S. households

received 121.4 billion pieces of mail, and sent 14.8 billion, as seen in Table

E.1. Mail sent or received by households constituted 83 percent of total mail

in FY 2012. Fifty-seven percent of the mail households received was sent Standard

Mail. Only three percent of household mail was sent between households; the

rest was sent between households and non-households.

Table E.1:

Mail Received and Sent by Households

(Billions of Pieces)

|

Mail

Classification

|

Received

|

Sent

|

|

First-Class Mail

|

45.5

|

14.4

|

|

Standard Regular Mail

|

55.8

|

—

|

|

Standard Nonprofit Mail

|

12.8

|

—

|

|

Periodicals

|

5.1

|

—

|

|

Package & Shipping

Services *

|

2.3

|

0.4

|

|

Total

|

121.4

|

14.8

|

|

Household to Household

|

4.5

|

|

Total Mail Received and Sent

by Households

|

131.7

|

|

FY 2012 RPW Total *

|

159.6

|

|

Non-household to

Non-household Residual

|

27.9

|

|

Unaddressed

|

1.0

|

—

|

Source: HDS Diary Sample, FY 2012.

Note: Totals may not sum due to rounding.

* Includes First-Class and Standard Mail packages.

Mail

Markets

The Household Diary Study

examines mail by the markets it serves. This design cuts across classes, but

provides a foundation for understanding mail flows and the marketplace changes

that affect them. Table E.2 shows the volume of household mail by market for 2010

through 2012.

Thirty five percent of household

mail contains correspondence and transactions, a share that is unchanged from

2011. In terms of volume, total correspondence fell 6.3 percent compared to 2011.

Since 2002, correspondence fell 38 percent. In part, the decline in

correspondence is a continuation of long-term trends, but it is also strongly related

to changing demographics and new technologies. Younger households send and

receive fewer pieces of correspondence mail because they tend to be early

adaptors of new and faster communication media such as e-mails, social

networking, and smart phones.

Table E.2:

Household Mail Volume Received and Sent by Market Served

(Billions of Pieces)

|

Market

|

2010

|

2011

|

2012

|

|

Correspondence

|

12.9

|

12.6

|

11.8

|

|

Transactions

|

37.6

|

35.6

|

34.3

|

|

Advertising

|

83.5

|

85.0

|

79.6

|

|

Periodicals

|

5.5

|

5.4

|

5.1

|

|

Packages

|

3.6

|

4.0

|

3.3

|

|

Unclassified

|

4.7

|

3.9

|

3.6

|

|

Total

|

141.2

|

139.1

|

131.7

|

Source: HDS Diary Sample, FY 2010,

2011, and 2012.

Notes:

Correspondence and Transactions include 6.1 billion pieces of First-Class advertising-enclosed

mail (excluded from totals).

Package volumes include ground packages and expedited, as well as

0.8 billion pieces of CD/DVD rentals.

Electronic alternatives also affect transactions mail

volume. Over time, automatic deduction and online bill pay account for a

growing share of household bill payments. Compared to 2002, the percentage of

bills paid by electronic methods increased from 17 percent to 56 percent in 2012.

In contrast, bills paid by mail decreased from 75 percent to 40 percent of

total payments over the same period of time. In-person payments decreased from

8 percent in 2002 to 4 percent in 2012. Similarly, the Internet has contributed

to some decline in the share of bills and statements households received

through the mail. Bills and statements received online continue to grow at a

fast pace, albeit from a relatively small base (in 2012 households received an

average of 1.7 pieces of bills and statements online, compared to 13.5 pieces

in the mail).

Advertising mail represented well over half (60 percent)

of all mail received by households in 2012. As shown in Table E.3, 86 percent

of all advertising mail received by households is Standard Mail (68.6 billion

pieces). The remainder consists of First-Class Mail; either stand-alone

advertising (4.9 billion pieces), or advertising-enclosed pieces that are sent

along with other matter (6.1 billion pieces).

Over time, the data show a steady decline in the share

of First-Class advertising mail, from 21 percent in 2002 to only 14 percent in

2012.

Table E.3:

Advertising by Mail Class

|

Mail

Classification

|

Volume

(Billions)

|

Percent of Total Advertising

|

|

First-Class Advertising

|

11.0

|

14%

|

|

Standard Regular Mail

|

55.8

|

70%

|

|

Standard Nonprofit Mail

|

12.8

|

16%

|

|

Total

Advertising Mail

|

79.6

|

100%

|

Source: HDS Diary Sample, FY 2012.

As shown in Table E.4, households received 5.1 billion

Periodicals via mail in 2012, less than in both 2010 and 2011. More than

three-quarters of these were magazines. Newspapers are only 15 percent of total

Periodicals, down from 35 percent in 1987. Contributors to the decline in

newspaper volumes were lower circulation and readership levels, as well as a

strong growth of the Internet as an alternative delivery method over the past

decade.

Table E.4:

Periodical Type Received

|

Mail

Classification

|

Volume

(Billions)

|

Percent of Total Periodicals

|

|

Newspapers

|

0.8

|

15%

|

|

Magazines

|

3.9

|

77%

|

|

Unclassified

|

0.4

|

8%

|

|

Total Periodicals

|

5.1

|

100%

|

Source: Household Diary Study,

FY 2012.

In 2012, households received 2.9 billion and sent 0.5

billion packages. Compared to 2011, total packages sent and received decreased

17 percent, with most of the decline coming from CD/DVD rentals included in First-Class

packages for this report. Excluding 0.8 billion pieces of CD/DVD rentals,

total packages sent and received increased 6.7 percent. In general, delivery

from mail order and Internet retailers is an important driver of package volume.

While the HDS data is not designed to quantify this, there are indications that

online auction sites (like eBay) are responsible for some of the recent

increase in packages sent by households.

Table E.5:

Packages Received and Sent via the U.S. Postal Service

(Millions of Pieces)

|

Mail Classification

|

2012

|

|

Received

|

Sent

|

|

Number

|

Percent

|

Number

|

Percent

|

|

First-Class Mail

|

1,077

|

38%

|

402

|

75%

|

|

Expedited

|

360

|

13%

|

70

|

13%

|

|

Standard Mail

|

513

|

18%

|

—

|

—

|

|

Package & Shipping

Services

|

791

|

28%

|

65

|

12%

|

|

Unclassified

|

106

|

4%

|

0

|

0%

|

|

Total Packages

|

2,847

|

100%

|

537

|

100%

|

Source: HDS Diary Sample, FY 2012.

Notes:

Totals may not sum due to rounding.

Expedited includes Priority Mail and Express Mail.

First-Class packages include 0.8 billion pieces of CD/DVD rentals sent to and

received from Netflix, Blockbuster, etc., reported in First-Class Mail letters

in Tables E.1, 1.5, and 1.6.

The United States Postal Service

Household Diary Study (HDS) Report documents the findings of the Fiscal Year

(FY) 2012 study. The HDS measures the mail sent and received by U.S.

households, tracks household mail trends, and compares mail use between

different types of households.

The Household Diary Study

provides a means to track

household mail trends over time.

The

Survey

The Household Diary Study survey, fielded continuously

since 1987, aims to collect information on household use of the mail and how

that use changes over time. The survey collects household information on:

·

Volumes of mail sent and received,

·

Demographics,

·

Attitudes toward mail and advertising,

·

Bill payment behavior, and

·

Use of the Internet and other information technologies.

These data are used for market research, forecasting, and

strategic planning within the Postal Service.

The Survey Consists of Two Parts:

1) An entry,

or recruitment interview, conducted by phone or Web, collects

demographic and attitudinal information from about 8,500 households.

2)

These households then receive a mail

diary, which collects information on the mail the household sends

and receives in a one-week period. Annually, about 5,200 households

successfully complete the diary.

The data generated by these two

instruments are the basis of the analysis in this report.

The HDS FY 2012 report covers the period from September 25,

2011, through September 28, 2012, roughly equivalent to the Government Fiscal

Year (GFY) used by the Postal Service. Data from FY 2010 and FY 2011 are also

reported on a GFY basis.

U.S.

Postal Service Volumes

Serving a nation containing five percent of the world’s

population, according to the Universal Postal Union, the Postal Service delivers

over 40 percent of the world’s mail. The Postal Service delivered 159.9 billion

pieces of mail in FY 2012—a decrease of 8.4 billion pieces, or 5.0 percent,

from 2011.

In 2012, mail volumes were negatively impacted by the

continuing migration of transaction and correspondence mail to the Internet and

other electronic alternatives. Additionally, the sluggish economic recovery

provided little or no boost to mail volumes.

Standard Mail volume, consisting mostly of advertising material,

declined 5.8 percent (about 5.0 billion pieces) from 2011 to 2012, driven by a

weak market for traditional advertising and a fragile economy.

In 2012, First-Class Mail volume fell 5.6 percent (about 4

billion pieces), continuing a long downward trend that began 2001. Ongoing

diversion of correspondence and transaction mail to electronic alternatives and

the weak economy were key contributors to the decline. First-Class Single-Piece

letters and cards, impacted mostly by the growing use of online bill payments

and emails, fell 8.1 percent from 2011 to 2012. Presort letters and cards

(which include most of the advertising material that is sent First-Class) fell

3.7 percent from the combined impact of electronic diversion and a sluggish

economy.

The Postal Service estimates the revenues, volumes, and

weight of mail pieces going through the postal network by using a combination

of statistical sampling systems, mailing statements, and accounting data. These

data are published in the Revenue, Pieces, and Weight (RPW) Reports.

Table 1.1 presents the RPW volumes for FY 2012, along with

data for FY 2011 and FY 2010.

Table 1.2 reports revenue, pieces, and weight data by

class and shape for FY 2012.

·

The letters column heading includes postcards and refers

to pieces that are less than 11.5 inches wide by 6.125 inches tall and less

than .25 inches thick.

·

Flats consist of pieces that are greater than 11.5 inches

wide, 6.125 inches tall, or .25 inches thick, but less than 12 by 15 by .75

inches.

·

Parcels are pieces that are larger than 12 by 15 inches,

or thicker than .75 inches.

Because of the difficulty involved in recording mail-piece

characteristics in the Household Diary, these categories do not correspond

precisely to the shape categories used by HDS respondents.

Table 1.3 is derived from Table 1.2 and shows the revenue

per piece and weight per piece for each subclass of mail by shape.

Table 1.1:

Total Mail Volume: FY 2010, 2011, and 2012

(Billions of Pieces)

|

Mail Classification

|

2010

|

2011

|

2012

|

|

Mailing Services:

|

|

|

|

|

First-Class Mail:

|

|

|

|

|

Single-Piece Letters &

Cards

|

28.9

|

26.0

|

23.9

|

|

Presort Letters &

Cards

|

46.2

|

44.3

|

42.5

|

|

Flats

|

2.5

|

2.2

|

2.1

|

|

Parcels

|

0.6

|

0.5

|

0.3

|

|

Other *

|

0.3

|

0.7

|

0.8

|

|

Total First-Class

Mail

|

78.2

|

73.7

|

69.6

|

|

Standard Mail:

|

|

|

|

|

High Density &

Saturation Letters

|

5.4

|

5.7

|

5.6

|

|

High Density &

Saturation Flats & Parcels

|

11.4

|

11.4

|

11.8

|

|

Carrier Route

|

9.4

|

9.3

|

9.1

|

|

Letters

|

48.3

|

50.6

|

46.2

|

|

Flats

|

7.0

|

6.8

|

5.9

|

|

Not Flat-Machinables &

Parcels

|

0.7

|

0.7

|

0.3

|

|

Other *

|

0.3

|

0.2

|

0.9

|

|

Total Standard Mail

|

82.5

|

84.7

|

79.8

|

|

Periodicals

|

7.3

|

7.1

|

6.7

|

|

Package Services

|

0.7

|

0.7

|

0.6

|

|

USPS and Free Mail

|

0.5

|

0.5

|

0.5

|

|

Total Mailing Services

|

169.2

|

166.7

|

157.3

|

|

Shipping Services

|

1.5

|

1.6

|

2.5

|

|

Total All Mail

|

170.9

|

168.3

|

159.9

|

Source: RPW Reports.

Note: Totals may not sum due to rounding.

* Other includes: Negotiated Service Agreements (NSAs), International Mail,

Express Mail, and Fees (not reported by shape).

Table 1.2:

Total Mail: Revenue, Pieces, and Weight by Shape, FY 2012

|

Mail Classification

|

Revenue

|

Pieces

|

Weight

|

|

(Millions of

Dollars)

|

(Millions of

Pieces)

|

(Millions of

Pounds)

|

|

Letters

|

Flats

|

Parcels

|

Total

|

Letters

|

Flats

|

Parcels

|

Total

|

Letters

|

Flats

|

Parcels

|

Total

|

|

Mailing Services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First-Class Mail:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-Piece Letters &

Cards

|

10,902

|

0

|

0

|

10,902

|

23,914

|

0

|

0

|

23,914

|

718

|

0

|

0

|

718

|

|

Presort Letters &

Cards

|

15,084

|

0

|

0

|

15,084

|

42,524

|

0

|

0

|

42,524

|

2,146

|

0

|

0

|

2,146

|

|

Flats

|

25

|

2,644

|

0

|

2,668

|

19

|

2,030

|

0

|

2,049

|

6

|

412

|

0

|

419

|

|

Parcels

|

0

|

103

|

546

|

649

|

0

|

56

|

237

|

293

|

0

|

15

|

77

|

91

|

|

Total First-Class By Shape

|

26,010

|

2,747

|

546

|

29,303

|

66,457

|

2,087

|

237

|

68,780

|

2,870

|

427

|

77

|

3,374

|

|

Other*

|

|

|

|

1,131

|

|

|

|

859

|

|

|

|

155

|

|

Total First-Class Mail

|

|

|

|

30,433

|

|

|

|

69,640

|

|

|

|

3,529

|

|

Standard Mail:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High Density &

Saturation Letters

|

767

|

0

|

0

|

767

|

5,564

|

0

|

0

|

5,564

|

234

|

0

|

0

|

234

|

|

High Density &

Saturation Flats & Parcels

|

76

|

1,874

|

0

|

1,951

|

532

|

11,237

|

1

|

11,770

|

25

|

2,122

|

0

|

2,148

|

|

Carrier Route

|

21

|

2,223

|

0

|

2,244

|

102

|

9,018

|

0

|

9,120

|

4

|

1,998

|

0

|

2,003

|

|

Letters

|

8,979

|

0

|

0

|

8,979

|

46,150

|

0

|

0

|

46,150

|

2,378

|

0

|

0

|

2,378

|

|

Flats

|

2

|

2,226

|

1

|

2,230

|

4

|

5,933

|

3

|

5,940

|

1

|

1,495

|

0

|

1,496

|

|

Not Flat-Machinables &

Parcels

|

0

|

0

|

285

|

285

|

0

|

0

|

304

|

304

|

0

|

0

|

126

|

126

|

|

Total Standard By Shape

|

9,845

|

6,324

|

287

|

16,456

|

52,351

|

26,188

|

308

|

78,847

|

2,642

|

5,615

|

127

|

8,384

|

|

Other*

|

|

|

|

257

|

|

|

|

954

|

|

|

|

42

|

|

Total Standard Mail

|

|

|

|

16,713

|

|

|

|

79,801

|

|

|

|

8,427

|

|

Periodicals:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Periodicals By Shape

|

12

|

1,707

|

4

|

1,723

|

67

|

6,668

|

6

|

6,741

|

5

|

2,521

|

10

|

2,535

|

|

Other *

|

|

|

|

8

|

|

|

|

0

|

|

|

|

0

|

|

Total Periodicals

|

|

|

|

1,731

|

|

|

|

6,741

|

|

|

|

2,535

|

|

Package Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Package Services

By Shape

|

0

|

213

|

1,373

|

1,586

|

0

|

240

|

405

|

645

|

0

|

351

|

1,407

|

1,757

|

|

Other*

|

|

|

|

24

|

|

|

|

1

|

|

|

|

19

|

|

Total Package Services

|

|

|

|

1,610

|

|

|

|

646

|

|

|

|

1,777

|

|

USPS and Free Mail

|

|

|

|

0

|

|

|

|

497

|

|

|

|

170

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Mailing Services

By Shape

|

35,867

|

10,992

|

2,209

|

49,068

|

118,874

|

35,183

|

956

|

155,014

|

5,518

|

8,914

|

1,620

|

16,051

|

|

Total Other*

|

|

|

|

1,421

|

|

|

|

2,312

|

|

|

|

386

|

|

Total Mailing Services

|

|

|

|

50,488

|

|

|

|

157,326

|

|

|

|

16,438

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shipping Services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Shipping Services

By Shape

|

23

|

881

|

7,367

|

8,271

|

5

|

186

|

2,029

|

2,220

|

0

|

126

|

3,588

|

3,715

|

|

Total Other*

|

|

|

|

2,640

|

|

|

|

313

|

|

|

|

342

|

|

Total Shipping Services

|

|

|

|

10,910

|

|

|

|

2,533

|

|

|

|

4,057

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total All Mail

|

|

|

|

61,399

|

|

|

|

159,859

|

|

|

|

20,495

|

|

Total All Services**

|

|

|

|

3,848

|

|

|

|

2,625

|

|

|

|

|

|

Total All Mail & Services

|

|

|

|

65,247

|

|

|

|

|

|

|

|

|

Source: RPW Reports.

Note: Totals may not sum due to rounding.

* Other includes: NSAs, International Mail, Express Mail and Fees (not reported

by shape).

** All Services include Ancillary and Special Services.

Table 1.3:

Total Mail: Revenue and Weight per Piece by Shape, FY 2012

|

Mail

Classification

|

Revenue per

Piece

|

Weight per

Piece

|

|

(Dollars)

|

(Ounces)

|

|

Letters

|

Flats

|

Parcels

|

Total

|

Letters

|

Flats

|

Parcels

|

Total

|

|

Mailing Services:

|

|

|

|

|

|

|

|

|

|

First-Class Mail:

|

|

|

|

|

|

|

|

|

|

Single-Piece Letters &

Cards

|

0.456

|

|

|

0.456

|

0.480

|

|

|

0.480

|

|

Presort Letters &

Cards

|

0.355

|

|

|

0.355

|

0.808

|

|

|

0.808

|

|

Flats

|

1.293

|

1.302

|

|

1.302

|

5.156

|

3.251

|

|

3.268

|

|

Parcels

|

|

1.827

|

2.303

|

2.211

|

|

4.172

|

5.167

|

4.976

|

|

Total First-Class By

Shape

|

0.391

|

1.316

|

2.303

|

0.426

|

0.691

|

3.276

|

5.167

|

0.785

|

|

Other*

|

|

|

|

1.316

|

|

|

|

2.889

|

|

Total First-Class

Mail

|

|

|

|

0.437

|

|

|

|

0.811

|

|

Standard Mail:

|

|

|

|

|

|

|

|

|

|

High Density &

Saturation Letters

|

0.138

|

|

|

0.138

|

0.672

|

|

|

0.672

|

|

High Density &

Saturation Flats

& Parcels

|

0.143

|

0.167

|

0.503

|

0.166

|

0.755

|

3.021

|

|

2.919

|

|

Carrier Route

|

0.204

|

0.247

|

0.684

|

0.246

|

0.671

|

3.545

|

6.739

|

3.514

|

|

Letters

|

0.195

|

|

|

0.195

|

0.825

|

|

|

0.825

|

|

Flats

|

0.472

|

0.375

|

0.456

|

0.375

|

4.264

|

4.031

|

0.627

|

4.029

|

|

Not Flat-Machinables &

Parcels

|

|

|

0.938

|

0.938

|

|

|

6.656

|

6.656

|

|

Total Standard By

Shape

|

0.188

|

0.241

|

0.932

|

0.209

|

0.808

|

3.431

|

6.597

|

1.701

|

|

Other*

|

|

|

|

0.270

|

|

|

|

0.710

|

|

Total Standard Mail

|

|

|

|

0.209

|

|

|

|

1.690

|

|

Periodicals

|

|

|

|

|

|

|

|

|

|

Total Periodicals By

Shape

|

0.177

|

0.256

|

0.701

|

0.256

|

1.185

|

6.049

|

24.517

|

6.018

|

|

Other*

|

|

|

|

|

|

|

|

|

|

Total Periodicals

|

|

|

|

0.257

|

|

|

|

6.018

|

|

Package Services

|

|

|

|

|

|

|

|

|

|

Total Package

Services

By Shape

|

0.000

|

0.888

|

3.390

|

2.458

|

0.000

|

23.339

|

55.586

|

43.575

|

|

Other*

|

|

|

|

|

|

|

|

|

|

Total Package

Services

|

|

|

|

2.491

|

|

|

|

43.977

|

|

USPS and Free Mail

|

|

|

|

0.000

|

|

|

|

4.841

|

|

|

|

|

|

|

|

|

|

|

|

Total Mailing Services

By Shape

|

0.302

|

0.312

|

2.311

|

0.317

|

0.743

|

4.054

|

27.107

|

1.657

|

|

Total Other*

|

|

|

|

0.614

|

|

|

|

2.674

|

|

Total Mailing Services

|

|

|

|

0.321

|

|

|

|

1.672

|

|

|

|

|

|

|

|

|

|

|

|

Shipping Services:

|

|

|

|

|

|

|

|

|

|

Total Shipping Services

By Shape

|

4.545

|

4.742

|

3.631

|

3.726

|

1.010

|

10.872

|

28.296

|

26.776

|

|

Total Other*

|

|

|

|

8.424

|

|

|

|

17.475

|

|

Total Shipping Services

|

|

|

|

4.307

|

|

|

|

25.625

|

|

|

|

|

|

|

|

|

|

|

|

Total All Mail

|

|

|

|

0.384

|

|

|

|

2.051

|

Source: RPW Reports.

Note: Totals may not sum due to rounding.

* Other includes: NSAs, International Mail, Express Mail, and Fees (not

reported by shape).

Mail

Flows

Mail volume can be broken into four basic flows, based on

origin and destination. These flows are:

1) Household

to household,

2) Household

to non-household,

3) Non-household

to household, and

4) Non-household

to non-household.

Table 1.4a shows the total mail in each flow, and Table

1.4b shows pieces per household per week.

Table 1.4a:

Total Domestic Mail Flows

(Billions of Pieces)

|

Sent

By:

|

Received By:

|

|

Household

|

Non-household

|

Total

Originating

|

|

Household

|

4.5

|

10.3

|

14.8

|

|

Non-household

|

116.9

|

28.2

|

145.1

|

|

Total Destinating

|

121.4

|

38.5

|

159.9

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

Table 1.4b:

Total Domestic Mail Flows

|

Mail Flows

|

Billions of Pieces

|

Percent of Total Mail

|

|

Sent by Household

|

14.8

|

9%

|

|

Non-Household to Household

|

116.9

|

73%

|

|

Total Household Mail

|

131.7

|

82%

|

|

Non-Household to

Non-Household

|

28.2

|

18%

|

|

Total Mail

|

159.9

|

100%

|

Table 1.4c:

Domestic Mail Flows per Household per Week

|

Sent

By:

|

Received By:

|

|

Household

|

Non-household

|

|

Household

|

0.7

|

1.6

|

|

Non-household

|

18.6

|

N/A

|

Source: Household Diary Study,

FY 2012.

Household Mail

As shown in Tables 1.4a-c, domestic mail to and from

households constituted 82 percent of total mail volume in 2012, which equates

to 20.9 pieces per week sent and received by U.S. households. Table 1.5

presents the volumes of mail sent and received by households as estimated from

the HDS. The table shows the categories in which the households record their

mail. Households received 121.4 billion pieces of mail and sent 14.8 billion.

Both of these totals include the 4.5 billion pieces of mail that households

sent to each other. The total mail received or sent by households in FY 2012

was 131.7 billion pieces.

Table 1.5:

Mail Received and Sent by Households

(Billions of Pieces)

|

Mail Classification

|

Received

|

Sent

|

|

First-Class Mail

|

45.5

|

14.4

|

|

Standard Regular Mail

|

55.8

|

—

|

|

Standard Nonprofit Mail

|

12.8

|

—

|

|

Periodicals

|

5.1

|

—

|

|

Packages & Shipping

Services*

|

2.3

|

0.4

|

|

Total

|

121.4

|

14.8

|

|

Household to Household

|

4.5

|

|

Total Mail Received and Sent

by Households

|

131.7

|

|

FY 2012 RPW Total

|

159.9

|

|

Non-household to

Non-household (Residual)

|

28.2

|

|

Unaddressed

|

1.0

|

—

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

* Includes First-Class and Standard Mail packages.

Table 1.6 presents these data in two

other forms, annual volumes per household and pieces per household per week.

Many of the subsequent results in this report are presented in terms of pieces

per household per week.

Table 1.6:

Pieces Received and Sent per Household

|

Classification

|

Annual Pieces per

Household

|

Pieces per Household

per Week

|

|

Mail Received

|

|

|

|

First-Class Mail

|

376

|

7.2

|

|

Standard Regular Mail

|

461

|

8.9

|

|

Standard Nonprofit Mail

|

106

|

2.0

|

|

Periodicals

|

42

|

0.8

|

|

Packages & Shipping

Services*

|

18

|

0.4

|

|

|

|

|

|

Total Mail Received

|

1,003

|

19.3

|

|

Mail Sent

|

|

|

|

First-Class Mail:

|

119

|

2.3

|

|

Packages & Shipping

Services*

|

3

|

0.0

|

|

|

|

|

|

Total

Mail Sent

|

122

|

2.3

|

|

Unaddressed

|

8

|

0.2

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

* Includes First-Class and Standard Mail packages.

Classes and Markets

·

First-Class Mail is used to send transactional mail,

correspondence, and advertising. Because it is limited to pieces weighing

thirteen ounces or less, it primarily includes letters and cards.

·

Standard Mail is advertising mail. For the most part,

Standard Mail comprises letters and flats, although it contains a few postcards

and packages as well.

·

Periodicals are magazines and newspapers, and are

predominantly flat-shaped.

·

Package and Shipping Services is used to deliver

merchandise, books, catalogs, and media such as CDs and DVDs. Most of this mail

is parcel-shaped.

Table 1.7 crosswalks between classes of mail and the

markets they serve.

Table 1.7:

Mail Received and Sent by Households

|

Class

|

Market (Billions

of Pieces)

|

|

Correspondence

|

Transactions

|

Advertising

|

Periodicals

|

Packages

|

Total

|

|

First-Class Mail

|

11.8

|

34.3

|

11.0

|

—

|

1.5

|

52.5

|

|

Standard Mail

|

—

|

—

|

68.5

|

—

|

0.5

|

69.1

|

|

Periodicals

|

—

|

—

|

—

|

5.1

|

—

|

5.1

|

|

Packages & Shipping

Services

|

—

|

—

|

—

|

—

|

1.3

|

1.3

|

|

Total

|

11.8

|

34.3

|

79.6

|

5.1

|

3.3

|

128.1

|

|

Unclassified

|

|

|

|

|

|

3.6

|

|

Total Mail Received and Sent

by Households

|

|

|

|

|

|

131.7

|

Source: HDS Diary Sample FY

2012.

Notes: Correspondence and Transactions include 6.1 billion pieces of secondary

advertising mail also reported in Advertising Mail.

The “Total” column for each class does not include pieces that could not be

identified according to markets (Unclassified).

First-Class Packages include 0.8 billion pieces of CD/DVD rentals sent to and

received from Netflix, Blockbuster, etc., reported in First-Class Mail letters

in Tables E.1, 1.5, and 1.6.

Report Organization

The rest of the Household

Diary Study report is organized around the markets the mail serves. Each

chapter contains an analysis of the trends in the HDS data, as well as a

discussion of how those trends affect and are affected by changes in the

broader market. The following provides an overview of each chapter.

Chapter 2: Profile of Mail

Usage gives an analysis of household demographics. This chapter examines

demographic trends over time and their impact on the mail, and discusses

attributing factors, such as access to technology and changing attitudes.

Chapter 3: Correspondence

examines mail that is used solely or primarily to deliver (non-sales-related)

communications, such as letters and greeting cards. This chapter includes analysis

of both personal and business correspondence.

Chapter 4: Transactions

reviews financial transactions in the mail and the impact of new technologies

on that market. It analyzes household bill payment trends with a focus on

technological and demographic change.

Chapter 5: Advertising Mail presents the

trends in mail used to deliver sales-related messages. It contains information

on household attitudes towards advertising by various media, treatment of

advertising mail, and demographic determinants of advertising mail receipt.

Chapter 6: Periodicals examines magazines and

newspapers delivered in the mail. It looks at how changing demographics are

affecting the market for periodicals, and what the implications are for future

volume.

Chapter 7: Packages analyzes household use of

various types of packages, and it discusses the household market for

merchandise delivery.

In addition, there are three appendices to the report:

Appendix A contains a set of comparative tables for

FY 1987, FY 2011, and FY 2012, organized by class of mail. A concordance is

presented for comparison with pre-2000 reports.

Appendix B documents the study methodology and discusses

how the data were collected, weighted, and adjusted, and compares demographic

data in the sample to that of the population as a whole.

Appendix C contains the instruments used to

administer the survey.

Introduction

This chapter provides information on demographic trends

and other factors affecting mail volume, providing a basis for assessing mail

volume changes. The breakouts introduced provide the basis for much of the

analyses in subsequent chapters.

The first section looks at growth in mail volume,

population, households, and delivery points over recent decades. The next

section examines the demographic characteristics of mail users, contrasting

higher-mail-volume households with lower-volume households. The third section

details the emerging demographic and technological trends that will affect the

future of mail. The last section examines some of the factors affecting the use

of post offices and mailboxes.

Mail

Volume and Demographics

Total U.S. mail volume grew from 110 billion pieces in

1981 to 160 billion in 2012, an increase of 45 percent. This growth outpaced

the rate of population growth and was close to household formation. Over the

same period, according to the U.S. Census Bureau, the adult population grew 34

percent and households grew about 47 percent. The number of places to which the

Postal Service delivers increased still faster, growing by 55 percent (see the

USPS annual reports). As Table 2.1 shows, however, volume decreased by an

average of 2.4 percent per year over the last eleven years (due to large

declines from 2007 onward), while U.S. population growth, household formation,

and delivery points increased by an average of about one percent per year. With

falling revenues and rising costs, the Postal Service suffered significant

financial losses towards the end of the decade.

Total U.S. mail volume decreased

by

an average of 2.4 percent per year

between 2001 and 2012,

while population and household

formation increased by an average

of about one percent per year.

The 1980s was a time of extraordinary mail volume growth

that began in 1978 and continued through 1988. In 1984, mail volume grew more

than ten percent. During this period, technology facilitated this growth.

Construction of computerized databases and techniques for sorting large amounts

of data created a fertile climate for direct mail marketing. Computerization of

financial systems encouraged billing by mail and payments through the mail.

These innovations in business processes were further encouraged by the

expansion of postal rate discounts.

The Postal Service introduced work-sharing discounts,

encouraging mailers to prepare the mail in ways that reduce the total system

cost of creating and delivering the mail. Mailers could take advantage of these

discounts by sorting the mail in advance. The Postal Service would receive the

mail presorted to the individual ZIP codes and/or to the carrier routes

associated with those ZIP codes.

In the late 1980s and early 1990s, mail volume growth

barely kept pace with household growth. The demand for mail was hurt by a

recession and two very large rate increases. This was also a period in which

the Postal Service absorbed substantial costs that were reapportioned from the

Federal government’s retirement programs.

Table 2.1:

Mail Volume and Demographics

Average Annual Growth, 1981-2012

|

|

1981-1990

|

1991-2000

|

2001-2012

|

|

Total

Mail Volume

|

4.6%

|

2.3%

|

-2.4%

|

|

Delivery

Points

|

1.7%

|

1.5%

|

0.9%

|

|

Adult

Population

|

1.5%

|

1.3%

|

1.2%

|

|

Households

|

1.4%

|

0.9%

|

1.0%

|

Source: U.S. Postal Service,

U.S. Census Bureau.

The latter half of the 1990s saw

rapid growth in mail volume, spurred by a strong economy and rates that

increased by less than inflation. The Postal Service also realigned the

incentives built into its price structure. It reduced the incentives mailers

had for presorting mail and encouraged them to prebarcode their mail. By 2002,

the majority of letters the Postal Service received had qualifying barcodes on

them. This restructuring of the rates took advantage of the extensive

automation of mail preparation and sorting that occurred in the previous

decade.

During the 1990s, the U.S. economy rapidly embraced

information technology and integrated the Internet into its business processes.

An economic recession followed that began in March 2001. The 2001 terrorist

attacks on the World Trade Center and the Pentagon led to large-scale

disruptions of those mail services dependent on air transport, such as

First-Class, Priority, and Express Mail. When air service was restored,

Priority Mail was no longer allowed on commercial passenger flights. Soon

afterwards, lethal anthrax was sent through the mail, which resulted in five

deaths and a number of serious injuries. These terrorist attacks, combined with

the economic recession, caused mail volume to decline 2.2 percent in 2002,

which was, at the time, the largest annual decline since World War II. In 2003,

Standard Mail volume recovered to a new high, but total First-Class volume

continued to decline. Work-shared First-Class Mail fell for the first time

ever. Since 2003, Standard Mail volume grew along with the economy, reaching

new highs and exceeding First-Class Mail for the first time in 2005. Total

First-Class volume, on the other hand, continued to decline, in part due to the

diversion of bills and statements to electronic alternatives and the lower-cost

Standard Mail option as an alternative to First-Class advertising.

The economic recession that began in December 2007 and

ended in June 2009 had a severe impact on the mail. Total mail volume plunged

12.7 percent in 2009—the largest decline since the Great Depression. In July

2009, the recession was officially over but was followed by a slow recovery

that continued through the end of 2012. As a result, total mail volume

declined an additional ten percent between 2009 and 2012. Both Standard Mail

and First-Class Mail contributed to the overall decline in mail volume, falling

3.8 and 18.0 percent respectively.

Between 2001 and 2012, total mail volume fell 23 percent.

During the same time period, the adult population increased 14 percent, households

increased 12 percent, and the Postal Service added ten percent more delivery

points to its network.

Continued growth in delivery

points

has become an ongoing source

of pressure on postal costs.

The Postal Service depends on

mail volume growth to fund universal service. The number of addresses the

delivery network serves increases as the number of American businesses and

households increases. When mail volume falls, as was the case between 2001 and 2012

the Postal Service’s ability to fund delivery service is hampered because the

Postal Service charges its customers for piece volume but does not assess

connect charges, access fees, or system fees, like many other network

enterprises.

Characteristics of Higher- and Lower-Volume Households

Tables 2.2 and 2.3 show the demographic characteristics of

households by the amount of mail received. It is apparent that household mail

use is strongly correlated with both income and education. Note, however, the

similar correlation between mail receipt and Internet access, which is also

related to income and education. Therefore, households that make the most use

of the mail are the households with the greatest opportunity to use

alternatives to the mail.

These high-volume households are taking advantage of the

opportunity to move away from the mail. Households that receive 30 or more

pieces of mail each week pay an average of 37 percent of their bills online, up

from 33 percent in 2010 and 35 percent in 2011. Households that receive less

than 30 pieces of mail each week are quickly catching up, however, as they paid

an average of 35 percent of their bills online. The percentage of online bill

payments among these lower-volume households has increased from 28 percent in

2010 and 30 percent in 2011.

Table 2.2:

Characteristics of Higher- and Lower-Mail-Volume Households

|

Mail Received

(Pieces per Household

per week)

|

Households

(Millions)

|

Median Annual

Household Income

|

Households w/

Internet Access

(Percent)

|

Total Paid

(Pieces

per Household per week)

|

Bills Paid by Internet

(Pieces

per Household per week)

|

Mail Sent

(Pieces

per Household per week)

|

|

45 or more

|

7.3

|

$101,193

|

92%

|

3.6

|

1.2

|

5.3

|

|

36-44

|

9.9

|

$89,536

|

91%

|

3.4

|

1.4

|

3.5

|

|

30-35

|

12.2

|

$79,756

|

93%

|

3.4

|

1.3

|

3.2

|

|

24-29

|

17.9

|

$71,508

|

89%

|

3.1

|

1.2

|

2.8

|

|

18-23

|

21.7

|

$58,618

|

87%

|

2.8

|

1.0

|

2.3

|

|

12-17

|

24.0

|

$44,778

|

80%

|

2.6

|

0.9

|

1.7

|

|

Less

than 12

|

28.1

|

$25,640

|

74%

|

1.9

|

0.6

|

1.2

|

|

Total

|

121.1

|

$55,913

|

84%

|

2.8

|

1.0

|

2.4

|

Source: HDS Diary Sample, FY

2012.

Note: Mail received includes USPS and Non-USPS mail.

Table 2.3:

Education of Higher- and Lower-Mail-Volume Households

|

Mail Received

(Pieces per Household

per week)

|

Households

(Millions)

|

Educational

Attainment of Head of Household

|

|

Less

than

High School

|

High

School Graduate

|

Some

College or Technical School

|

College

Graduate

|

|

45

or more

|

7.3

|

8%

|

12%

|

15%

|

65%

|

|

36-44

|

9.9

|

6%

|

23%

|

19%

|

52%

|

|

30-35

|

12.2

|

9%

|

22%

|

22%

|

47%

|

|

24-29

|

17.9

|

7%

|

30%

|

22%

|

40%

|

|

18-23

|

21.7

|

9%

|

35%

|

23%

|

32%

|

|

12-17

|

24.0

|

16%

|

32%

|

23%

|

29%

|

|

Less

than 12

|

28.1

|

18%

|

29%

|

25%

|

27%

|

|

Total

|

121.1

|

12%

|

29%

|

22%

|

37%

|

Source: HDS Diary Sample, FY 2012.

Note: Percentages may not total 100 percent due to heads of households who did

not answer the educational attainment question.

Percentages in this table are row percentages.

Excludes households not receiving any mail delivery at their home address

(using mailbox only).

Demographic

Characteristics of

U.S. Households

This section develops breakouts of households by demographic

categories that influence the volume of mail sent and received. It looks at

both traditional and newly emerging factors. The following chapters will show

how mail volume varies with these household characteristics.

Income, Education, and Age

Traditionally, mail use was largely determined by

household income, education, and age. As Table 2.4 shows, income and education

are strongly correlated with each other, as expected.

The relationship between income and age, shown in Table

2.5, is somewhat more complicated. Up to retirement, household income and age

are fairly closely related. After retirement, households earn substantially

less; although by that point, mail behavior is pretty well set, and older

households continue to receive similar amounts of advertising and periodicals,

and pay similar amounts of bills, even though their income declines.

Table 2.4:

Households by Income and Education

(Percent of Households)

|

Household Income

(Thousands)

|

Educational

Attainment of Head of Household

|

Total

|

|

Less

than

High School

|

High

School Graduate

|

Some

College or Technical School

|

College

Graduate

|

|

Under

$35

|

25%

|

36%

|

24%

|

15%

|

100%

|

|

$35

to $65

|

11%

|

34%

|

26%

|

29%

|

100%

|

|

$65

to $100

|

4%

|

26%

|

22%

|

48%

|

100%

|

|

Over

$100

|

1%

|

14%

|

18%

|

67%

|

100%

|

|

Don’t

know/

Refused

|

9%

|

26%

|

20%

|

42%

|

100%

|

|

Total

|

12%

|

29%

|

22%

|

37%

|

100%

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

Table 2.5:

Households by Income and Age

(Percent of Households)

|

Household Income

(Thousands)

|

Age of Head of

Household

|

Total

|

|

Under 35

|

35 to 54

|

Over 55

|

Don’t Know/ Refused

|

|

Under

$35

|

22%

|

28%

|

50%

|

0%

|

100%

|

|

$35

to $65

|

24%

|

34%

|

41%

|

0%

|

100%

|

|

$65

to $100

|

21%

|

45%

|

34%

|

0%

|

100%

|

|

Over

$100

|

15%

|

53%

|

32%

|

0%

|

100%

|

|

Don’t

know/

Refused

|

24%

|

29%

|

42%

|

5%

|

100%

|

|

Total

|

21%

|

37%

|

41%

|

1%

|

100%

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

Household Size

The majority of U.S. households include either one or two

adults, but households with three or more adults make up 19 percent of the

total. Once considered the norm, nuclear families—two adults and at least one

child—now account for only 20 percent of households (per the U.S. Census

Bureau). The changing composition of households impacted the amount and kinds

of mail sent and received by households over the past 20 years, generating more

and different kinds of advertising mail, as well as affecting transaction mail

trends (bills tend to be tied to households as much as to individuals).

Table 2.6:

Households by Number of Adults

(Millions of Households)

|

Number of Adults

|

|

|

One

|

28.2

|

|

Two

|

70.0

|

|

Three

or more

|

22.9

|

|

Total Households

|

121.1

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

Table 2.7:

Households by Size

(Millions of Households)

|

Household Size

|

|

|

One

person

|

24.7

|

|

Two

|

45.0

|

|

Three

|

20.1

|

|

Four

|

17.5

|

|

Five

or more

|

13.8

|

|

Total

Households

|

121.1

|

Source: HDS Diary Sample, FY 2012.

Note: Total may not sum due to rounding.

Internet

Access

Access to the Internet and use of new technologies, such

as Broadband, have a large and growing impact on mail use. Bills, statements, and

bill payments still represent a significant number of pieces sent and received

by households. However, electronic activity in this area is diverting mail once

used for these purposes. On the other hand, online shopping potentially adds

packages and catalog delivery to the Postal Service mail stream.

Table 2.8 shows that 84 percent of households have

Internet access and 79 percent have Broadband access. The highest levels of Internet

and Broadband access are within households with incomes over $100,000 (98 and

95 percent, respectively), as seen in Figure 2.1a. In comparison, households

with incomes below $35,000 are less likely to have access to the Internet and

Broadband (61 and 54 percent, respectively). As shown in

Figure 2.1b, age is also an important determinant of households having Internet

access. Younger households (heads of households younger than 35 years old) are

more likely to have access to both the Internet and Broadband (93 and 90

percent, respectively). Older households (heads of households older than 55

years of age), on the other hand, are less likely to have access to the

Internet and Broadband (67 and 60 percent, respectively).

Table 2.8:

Households by Type of Internet Access

(Millions of Households)

|

Type of

Internet Access

|

|

|

Broadband

|

95.5

|

|

Dial-up

|

6.5

|

|

None

|

19.0

|

|

Total Households

|

121.1

|

Source: HDS Diary Sample, FY

2012.

Note: Totals may not sum due to rounding.

Figure 2.2 shows the trend in Broadband

connections. The rapid growth of Broadband expands the potential scope of

electronic diversion of the mail. The Internet’s fast, always-on connection makes

it a stronger alternative medium for the delivery of entertainment,

information, and communication. As more households begin using Broadband, the

more that bill payments, bill and statement presentment, periodicals, and even

advertising mail, will be affected.

Figure 2.1a:

Internet Access by Income and Type

Source: HDS Recruitment Data, FY 2012.

Note: Sum of Internet Access and None

does not equal 100 percent due to missing responses and access outside the home

only. Sum of Broadband and Dial-up does not equal the 100 percent due to

missing responses.

Figure 2.1b:

Internet Access by Age and Type

Source: HDS Recruitment Data,

FY 2012.

Note: Sum of Internet Access and None

does not equal 100 percent due to missing responses and access outside the home

only. Sum of Broadband and Dial-up does not equal the 100 percent due to

missing responses.

Figure 2.2:

Broadband Subscribers

Source: Leichtman Research

Group.

Use

of the Post Office

The Postal Service currently owns and operates 31,272 post

office locations throughout the U.S.

As shown in Figure 2.3, in spite of a declining frequency of visits over the

past five years, the use of post offices for mailing services continues to

dominate the mail service industry. Sixty percent of all U.S. households

patronize a post office at least once a month, while just 11 percent visit a

private mailing company. Over 28 percent of all households in the U.S. visit

the post office three or more times a month. Even with the continued

availability of mail-related products and services through alternative modes

(such as Internet orders), in-person visits to postal facilities remain strong.

A rented mailbox is one alternative that households use to

manage their mail. In 2012, 3 percent of all households in the U.S. rented

mailboxes from the Postal Service, and 1 percent rented a box from a private

company. Post office box use, however, declined in the past ten years, with 3

percent of U.S. households renting a post office box from the Postal Service in

2012, compared to 10 percent in 2001.

Introduction

This chapter examines correspondence mail among households

and between households and businesses, including letters, greeting cards,

invitations, and announcements. In several cases, this chapter, and several

following it, examines comparisons in data between 2010 and 2012, providing an

illustration of mail trends over time.

Correspondence

Mail Volume

Total correspondence sent and received represents about nine

percent of all household mail volumes, as shown in Table E.2. Table 3.1

provides a recent history of total correspondence volumes, showing an 8.4

percent decline from 2010 to 2012. Personal correspondence, which is

essentially household to household mail, fell 13.2 percent from 2010 to 2012,

continuing a long-term decline that started 25 years ago. In 1987, households

reported receiving 1.6 pieces of personal correspondence each week. By 2012,

personal correspondence received declined 56 percent, to just 0.7 pieces per

household per week.

In large part, this decline stemmed from competition from

an ever-changing landscape of communication technologies, such as affordable long-distance

telephone service and, more recently, e-mail, social networking, and cellular

communications—all of which provide an alternative to personal letters and

business inquiries. Such advances in technological communications completely

transformed the marketplace, and continue to have an impact on personal

correspondence.

Correspondence

Mail and

Household Characteristics

The following tables break down correspondence mail sent

and received by households using the demographic categories developed in

Chapter 2.

Income, Education, and Age

Tables 3.2 and 3.3 on the following page show that both

household income and educational attainment have a strong effect on

correspondence sent and received by households. In many cases, the volume of

correspondence sent and received by households with the highest income or the

highest education is more than double the volume that is sent and received by

households with the lowest income or the lowest education.

Table 3.1:

First-Class Correspondence Mail Sent and Received by Sector

|

Sector

|

Volume (Millions

of Pieces)

|

Change,

2010-2012

|

|

2010

|

2011

|

2012

|

|

Household to household

|

4,959

|

4,387

|

4,302

|

-13.2%

|

|

Non-household to household

|

6,082

|

6,464

|

6,079

|

0.0%

|

|

Household to non-household

|

1,882

|

1,762

|

1,453

|

-22.8%

|

|

Total

|

12,922

|

12,613

|

11,833

|

-8.4%

|

|

Sector

|

Pieces per Household

per Week

|

Share of 2012 Total

|

|

2010

|

2011

|

2012

|

|

Household

to household

|

0.8

|

0.7

|

0.7

|

36.4%

|

|

Non-household

to household

|

1.0

|

1.0

|

1.0

|

51.4%

|

|

Household

to non-household

|

0.3

|

0.3

|

0.2

|

12.3%

|

|

Total

|

2.1

|

2.0

|

1.9

|

100%

|

Source: HDS Diary Sample, FY 2010,

2011, and 2012.

Notes: Totals may not sum due to rounding.

.

Table 3.2:

Correspondence Mail Received by Income and Education

(Pieces per Household per

Week)

|

Household Income (Thousands)

|

Educational

Attainment of Head of Household

|

Average

|

|

Less

than

High School

|

High

School Graduate

|

Some

College or Technical School

|

College

Graduate

|

|

Under

$35

|

0.7