To facilitate processing of 2009 tax information and to ensure correct and timely receipt of a 2009 Form W-2, Wage and Tax Statement, all employees must have a current mailing address on file.

If you need to change your current mailing address, you have a number of options. In order of preference:

The following options are available for employees to change their mailing address on record:

1. By mail, send PS Form 1216, Employee’s Current Mailing Address, to:

HRSSC Compensation and Benefits

PO Box 970400

Greensboro, NC 27497-0400

2. By telephone, call Human Resources Shared Service Center (HRSSC) at 877-477-3273, option 5; validate your identity with your employee identification number (EIN) or Postal Service™ PIN, then option 9, to speak to a service representative who will assist you.

3. All postal employees can change their mailing and residential addresses using the personnel computer kiosks located in large processing and distribution centers and Post Offices™. A tab titled Present Job Info/Change of Address appears on the main kiosk webpage.

4. For employees with PC access, use the Blue Page to change your address:

n Select Log On from the upper left of the Blue Page.

n Log on with your ACE ID and Password.

n Ensure the welcome screen has your name on it (upper left corner).

n Select the tab labeled My Life. Under this tab, on the right side of the page is the heading My Profile, where you will find two links titled Address/Phone and Emergency Contact. Select Address/Phone.

n Select the Mailing Address type form the dropdown and click the Change button.

n Make the desired changes and click Save.

Note: Employee Self-Service is no longer an option to change employee’s address.

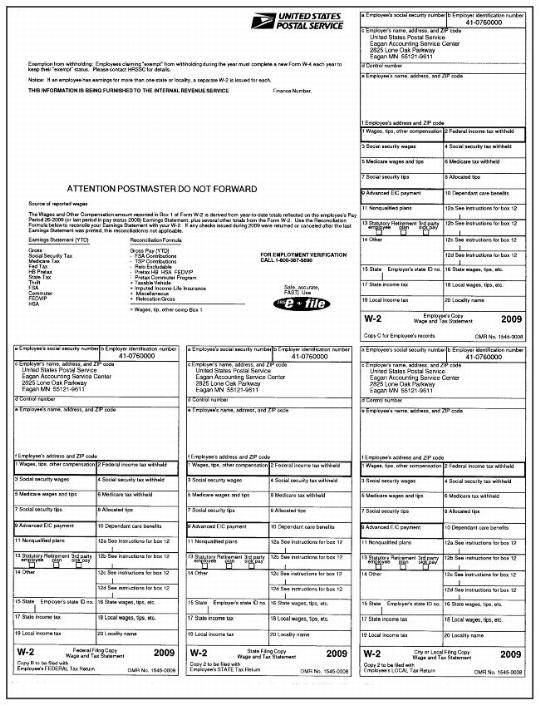

If an employee has earnings for more than one state or locality, a separate Form W-2 will be issued for each. The 2009 Form W-2 has been modified from the 2008 version to more closely follow the standard Internal Revenue Service (IRS) format.

All inquiries concerning payroll items, such as Employee Business Expense, Equipment Maintenance, Rent, T-Cola, money differences between earnings statement and W-2, (See Reconciliation Formula on Form W-2) leave buy backs, erroneous state or local tax deductions, TSP, FSA, etc., should be directed to the Accounting Help Desk at 866-974-2733.

Callers should be ready to provide the following information:

1. Employee’s name.

2. Current mailing address.

3. Social Security number.

4. Name of office where employed (or previously employed if not a current Postal Service employee).

5. Year(s) involved.

6. Specific question.

OR

Submit questions regarding Form W-2’s in writing. The request must include:

1. Employee’s name.

2. Current mailing address.

3. Social Security number.

4. Name of office where employed (or where previously employed if not a current Postal Service employee).

5. Year(s) involved.

6. Specific question.

7. Employee’s signature.

The Imputed Income Life Insurance amount shown in Box 12 and a letter code of “C” on the 2009 W-2 form is the net result of the IRS computation for taxable insurance benefits less the amount an employee pays for optional insurance in the calendar year.

The IRS requires the Postal Service to report as income the cost of Group Term Life Insurance in excess of $50,000, which is paid by the employer. The formula is based on an employee’s age, salary, and life insurance coverage.

The following facts will clarify some of the common tax questions regarding TSP:

a. Box 12a, 12b, 12c, or 12d (see Instructions for Box 12) may contain employee TSP contributions including TSP catchup.

b. TSP contributions are reported in Box 12a, 12b, 12c, or 12d, with a code “D”. Letter code “D” is explained in “Notice to Employee” on the reverse side of Form W-2.

c. Box 1, “Wages, tips, other compensation”, has been reduced by the amount of the employee’s TSP contributions shown in Box 12a, 12b, 12c, or 12d.

d. Box 16, “State wages, tips, etc.”, has been reduced by the amount of employee TSP contributions and may be reported in in Box 12a, 12b, 12c, or 12d for all states except New Jersey, Pennsylvania, and Puerto Rico.

e. New York City, NY, Kansas City, MO, Detroit, MI, St. Louis, MO, and Madison County, KY, are the only localities that allow income deferral for TSP. Box 18, “Local wages, tips, etc.”, will be reduced by the amount of employee TSP contributions only if New York City, NY, Kansas City, MO, Detroit, MI, St. Louis, MO, or Madison County, KY, is indicated in Box 20, “Locality name”.

Equipment Maintenance Allowance (EMA), Carrier Drive-Out, Vehicle Hire, Supervisor Vehicle Usage, and Special Delivery are all considered employee expenses and may be reported in Box 12a, 12b, 12c, or 12d. A letter code of “L” will contain the non-taxable (not the total) EBE amount.

The amount contributed to an employee’s Flexible Spending Account for health care and the amount contributed to dependent care will be included in Box 10, “Dependent care benefits”. Both have been deducted from Box 1, “Wages, tips, other compensation”.

The amount contributed for Health Benefit premiums are considered pre-tax unless the employee declined the pre-tax benefit. The Health Benefit pre-tax amount has been deducted from Box 1, “Wages, tips, other compensation” and is reflected in the reconciliation formula. Health Savings Accounts may be reported in Box 12a, 12b, 12c, or 12d with a letter code of “W”.

The amount contributed for Federal Employees Dental and Vision Insurance Program (FEDVIP) is considered pre-tax unless the employee declined the pre-tax amount, which has been deducted from Box 1, “Wages, tips, other compensation” and is reflected in the reconciliation formula.

The amount contributed for the Commuter Program is considered pre-tax for 2009 up to the IRS $230 monthly limit for public transportation and/or the IRS $230 monthly limit for parking and has been deducted from Box 1, “Wages, tips, other compensation” and is reflected in the reconciliation formula. Any commuting expenses that are elected over the IRS limits will be considered post–tax.

The amount in Box 16, “State wages, tips, etc.”, will equal Box 1 with the following exceptions:

n Mississippi does not allow income deferral for pre-tax commuter program public transportation and parking.

n New Jersey and Puerto Rico do not allow income deferral. Therefore, the employee TSP, FSA, FEDVIP, Commuter Program pre-tax contributions, and HB pre-tax contributions are not deducted from their State Gross.

n Pennsylvania is the only state that does not require the Imputed Income Life Insurance to be added into the State Gross. Also, Pennsylvania does not allow income deferral for TSP, FSA Dependant Care, and Commuter Program pre–tax contributions.

Form W-2s are issued to former employees who receive payments from the Postal Service under the Annuity Protection Program. Any questions regarding these Form W-2s should be directed to:

Payroll Benefits Branch

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9621

Relocation wages are reported in Box 12 on Form W-2.

Relocation gross is reduced by the excludable reportable amount reported in Box 12a, 12b, 12c, or 12d before it is added to Box 1, “Wages, tips, other compensation”.

Excludable reportable moving expenses reimbursements may be reported in Box 12a 12b, 12c, or 12d with a code “P” and reflected in the reconciliation formula.

Employees may use PostalEASE “W-2 Re-print” for information viewing and/or printing. You may request any of the prior 15 years including the current year to be reprinted on an official document and mailed.

The W-2 re-print process is performed weekly and will be available for use at the beginning of February 2010. During the months of March and April, the W-2 re-print process is scheduled to execute daily. During Pay Periods 01-03 (approximately mid-December through the end of January), the W-2 request for mailing process will not be available. However, viewing of current information is available online.

To obtain duplicate forms, employees may also call the Accounting Help Desk (866-974-2733).

All requests must include:

1. Employee’s name.

2. Current mailing address.

3. Social Security number.

4. Name of office where employed (or where previously employed if not a current Postal Service employee).

5. Year(s) requested.

* If unsuccessful requesting duplicate W-2s from the Accounting Help Desk or Employee Self Service, or for any other W-2 request, duplicates can also be requested in writing from: Financial Reporting Section (W-2s), Eagan Accounting Services, 2825 Lone Oak Parkway, Eagan, MN 55121-9617. Requests must include the employee’s signature.

1. General Form W-2c Information

Form W-2c is used by the Postal Service to correct errors previously filed on a Form W-2. The Form W-2c will only report the corrections and should be used in conjunction with the original Form W-2 issued when filing taxes and/or other related information.

2. Requesting a Form W-2c

All requests for a corrected Form W-2c must be submitted in writing. The request must include:

1. Employee’s name.

2. Current mailing address.

3. Social Security number.

4. Name of office where employed (or where previously employed if not a current Postal Service employee).

5. Year(s) requested.

6. Reason for request.

7. Employee’s signature.

3. Obtaining Duplicate Form W-2c

All requests for a duplicate Form W-2c must be submitted in writing. The request must include:

1. Employee’s name.

2. Current mailing address.

3. Social Security number.

4. Name of office where employed (or where previously employed if not a current Postal Service employee).

5. Year(s) request.

6. Employee’s signature.

Depending on your specific circumstances, up to three different IRS Form 1099’s may be issued to you. They are:

n IRS Form 1099MISC, Statement for Recipients of Miscellaneous Income.

n IRS Form 1099R, Distributions from Pensions, Annuities, Retirement, or Profit Sharing Plans, IRAs, Insurance Contracts, etc.

n IRS Form 1099INT, Interest Income.

This form originates from Accounting Services. Please determine the nature of the payments and contact the appropriate Accounting Services office.

Requests for duplicate copies and questions regarding…

|

Should be directed to…

|

Payments to the beneficiaries of deceased employees of the unpaid compensation due at the time of death. Provide name, SSN, and date of death of the deceased.

|

Financial Processing Section

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9616

|

Lump sum payments with no deductions as the result of settlements. Provide name, SSN, date of settlement, type of settlement, amount of settlement, period involved, and the date it was sent to the ASC for payment.

|

Financial Processing Section

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9616

|

Contract Cleaners

|

Contract Cleaners Unit

San Mateo Accounting Services

2700 Campus Drive

San Mateo, CA 94497-9426

|

All Others…

|

San Mateo Accounting Services

Attn: 1099 Research Team

2700 Campus Drive

San Mateo, CA 94497-9422

|

This year, both the Office of Personnel Management (OPM) and the Eagan Accounting Services are sending out 1099–R’s. The Eagan Accounting Services office issues a 1099R for annuity protection checks, and OPM issues a 1099R for monthly annuity checks. The originating agency should be listed on the Form 1099R. Try to determine which agency made the payments before making the inquiry.

The use of this form is to report interest payments that were the result of employment-related back pay awards.

— Payroll, Controller, 1-14-10

Form W-2