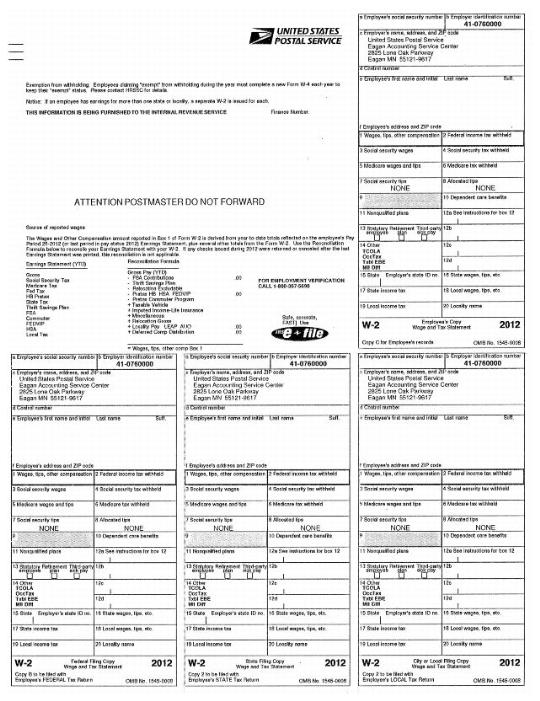

If an employee has earnings from more than one state or locality, a separate Form W-2 (see pages 21–22) will be issued for each. The format of the 2012 Form W-2 remains unchanged from the 2011 version.

However, with the discontinuation of Advanced Earned Income Credit (EIC) Payments in 2011, Box 9 is shaded and no longer serves to identify monies of any type. All box numbers remain unchanged from the 2011 version.

New codes “AA” (TSP Roth), “DD” (Cost of Employer-Sponsored Health Coverage), and “Y” (Nonqualified Deferred Compensation) are shown in Box 12. Additionally, distributed deferred compensation is reported in Box 11.

An employee may be able to take the Earned Income Credit (EIC) for 2012, if s/he meets qualifying requirements. Details are printed in the “Notice to Employee” section of the Form W-2. (An employee may also qualify for a state EIC credit. Employees should visit applicable state taxing authority websites to determine eligibility.)

Direct all inquiries concerning payroll items, such as employee business expense, equipment maintenance, rent, TCOLA, money differences between earnings statement and Form W-2 (See Reconciliation Formula on Form W-2), leave buy backs, erroneous state or local tax deductions, TSP, FSA, etc., to the Accounting Help Desk at 866-974-2733.

Provide the following information:

n Employee name.

n Current mailing address.

n Social Security number and/or Employee ID.

n Name of office where employed (or previously employed, if not a current Postal Service employee).

n Year(s) involved.

n Specific question.

Submit questions regarding Forms W-2 in writing.

All requests must include the following:

n Employee name.

n Current mailing address.

n Social Security number and/or Employee ID.

n Name of office where employed (or previously employed, if not a current Postal Service employee).

n Year(s) involved.

n Specific question.

n Employee signature.

n Imputed Income Life Insurance is reported in Box 12 (letter code “C”). It is the net result of the IRS computation for taxable insurance benefits less the calendar year amount the employee paid for optional insurance. (The formula is based on employee’s age, salary, and life insurance coverage.) The IRS requires employers to report as income the employer cost of Group Term Life Insurance in excess of $50,000.

n Per the Reconciliation Formula, Imputed Income Life Insurance (Box 12) is added to gross pay and is included in Box 1 (Wages, tips, other compensation).

n Employee TSP traditional contributions including TSP Catch-up are reported in Box 12 (letter code “D”).

n Per the Reconciliation Formula, traditional TSP contributions (Box 12, letter code “D”) are subtracted from gross pay and are not included in Box 1 (Wages, tips, other compensation).

n TSP Roth contributions including TSP Catch-Up are reported in Box 12 (letter code “AA”). TSP Roth contributions do not reduce gross pay; they are included in Box 1 (Wages, tips, other compensation). Roth contributions (letter code “AA”) are reported for your information only.

Equipment maintenance allowance (EMA), carrier drive-out, vehicle hire, and supervisor vehicle usage are considered employee expenses. The nontaxable (not the total) EBE amount is reported in Box 12 (letter code “L”). If there is a taxable amount, it is reported in Box 14 (Other). Per the Reconciliation Formula, taxable vehicle (Box 14) is added to gross pay and is included in Box 1 (Wages, tips, other compensation).

Flexible Spending Accounts (FSA): Dependent Care (DC) and Health Care (HC)

n Employee contributions to an FSA for dependent care are reported in Box 10 (Dependent Care Benefits). Per the Reconciliation Formula, FSA contributions are subtracted from gross pay and are not included in Box 1 (Wages, tips, other compensation).

n Employee contributions to an FSA for health care are not reported separately in any box on the Form W-2. Per the Reconciliation Formula, FSA contributions are subtracted from gross pay and are not included in the gross wages reported in Box 1 (Wages, tips, other compensation). See the Pay Period 26-12 earnings statement for the total Health Care FSA amount.

n Employee payments for HB premiums are considered pretax unless the employee declined the pretax benefit. Employee pretax HB premium payments are no longer reported separately in any box on the Form W-2. Per the Reconciliation Formula, employee pretax HB premium payments are subtracted from gross pay and are not included in the gross wages reported in Box 1 (Wages, tips, other compensation). See the Pay Period 26-12 earnings statement for the total employee pretax HB premium payment amount.

n The Cost of Employer-Sponsored Health Coverage (employer costs plus employee pre-tax and post-tax costs) is reported in Box 12 (letter code “DD”). Reporting is required by the Affordable Care Act but is reported for informational purposes only. The amount reported is not taxable.

HSA contributions are reported in Box 12 (letter code “W”). Per the Reconciliation Formula, HSA contributions (Box 12) are subtracted from gross pay and are not included in the gross wages reported in Box 1 (Wages, tips, other compensation). See the Pay Period 26-12 earnings statement for the total employee contribution HSA amount.

Employee payments for FEDVIP premiums are considered pretax. Per the Reconciliation Formula, employee FEDVIP premium payments are subtracted from gross pay and are not included in the gross wages reported in Box 1 (Wages, tips, other compensation). See the Pay Period 26-12 earnings statement for the total employee FEDVIP premium payment amount.

Employee contributions for the Commuter Program are considered pretax for 2012 up to the IRS $125 monthly limit (annual $1,550) for public transportation and/or the IRS $240 monthly limit (annual $2,930) for parking. Per the Reconciliation Formula, employee pretax commuter contributions are subtracted from gross pay and are not included in Box 1 (Wages, tips, other compensation). See the Pay Period 26-12 earnings statement for the total Commuter Program amount. Any commuting contributions elected over the IRS limits are considered post-tax.

Qualified relocation (excludable) reimbursements paid directly to an employee are reported in Box 12 (letter code “P”). Per the Reconciliation Formula, Relocation Gross is added to gross pay while Relocation Excludable (Box 12) is subtracted from gross pay. The net difference between Relocation Gross and Relocation Excludable is included in Box 1 (Wages, tips, other compensation). See the statements issued to you by CARTUS, the relocation service for the Postal Service™, if you need additional information.

Military Differential Payments are reported in Box 14 (Other) and are included in Box 1 (Wages, tips, other compensation) as well as Box 16 (State Wages, tips, etc.) and Box 18 (Local Wages, tips, etc.). Differential payments made to an individual while on active duty for more than 30 days are not subject to Social Security and Medicare taxes. Differential payments made to an individual while on active duty for 30 days or less are subject to Social Security and Medicare taxes.

n Nonqualified Deferred Compensation is reported in Box 12 (letter code “Y”).

n Additionally, distributed Nonqualified Deferred Compensation is reported in Box 11 (Nonqualified plans). Per the Reconciliation Formula, Nonqualified Deferred Compensation (Box 11) is included in Box 1 (Wages, tips, other compensation).

The amount in Box 16 (State wages, tips, etc) will equal Box 1 (Wages, tips, other compensation) with the following exceptions:

n California and Wisconsin do not allow income deferral for Health Savings Accounts (HSAs).

n Mississippi does not allow income deferral for pretax commuter program public transportation and parking.

n New Jersey and Puerto Rico do not allow income deferral. Therefore, employee TSP, FSA, FEDVIP, Commuter Program pretax contributions, HB pretax contributions, and HSAs are not subtracted from state gross pay for New Jersey and Puerto Rico.

n Pennsylvania is the only state that does not require the addition of Imputed Income Life Insurance to state gross pay. Also, Pennsylvania does not allow income deferral for TSP, FSA Dependant Care, and Commuter Program pretax contributions.

n Hawaii includes Territorial COLA (TCOLA) in Box 16 (State wages, tips, etc.).

The following statements do not take into account taxable wage limits that exist for certain localities. For those localities, amounts in Box 18 (Local wages, tips, etc.) will not exceed local taxable wage limits.

The amount in Box 18 (Local wages, tips, etc) will equal gross pay with the following exceptions:

n New York City, NY; St. Louis, MO; and MI Locals (Battle Creek, Detroit, Flint, Grand Rapids, Lansing, Pontiac, and Saginaw): Local taxable wages are the same as the federal taxable wages reported in Box 1 (Wages, tips, other compensation).

n Kansas City, MO, and Madison County, KY: Local taxable wages are federal taxable wages plus HSA.

n OH Locals (Akron, Brecksville, Brook Park, Canton, Cincinnati, Cleveland, Columbus, Dayton, Fairview Park, Heath, Kettering, Mansfield, Newark, Oberlin, Sharonville, Springfield, Toledo, Whitehall, and Youngstown): Local taxable wages are federal taxable wages plus TSP and minus Imputed Income Life Insurance.

n With the exception of Philadelphia and Pittsburgh, PA Locals (Bethlehem, Erie, Greene, Hanover, Harrisburg, Horsham, Lancaster, Middletown, Reading, Scranton, Sunbury/Gregg, Tinicum, Warminster, Wilkes-Barre, and York) are the same as the PA taxable wages reported in Box 16 (State wages, tips, etc).

Forms W-2 are issued to former employees who receive payments from the Postal Service under the Annuity Protection Program. Direct questions regarding such Forms W-2 to the following address:

Payroll Benefits Branch

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9621

Employees may use PostalEASE “W-2” to view and/or print official electronic copies of Forms W-2 for any of the last seven years, including the most recent W-2 year. Employees may also request reprint copies of Forms W-2 from the last seven years be mailed to their home addresses.

Also available in the PostalEASE “W-2” module is the option to elect not to receive mailed copies of Forms W-2 in the future, in lieu of the electronic Forms W-2.

The “W-2” process is performed weekly, except during the months of March and April, when it is performed daily. During Pay Periods 01-13 to 03-13, the W-2 request for mailing process will not be available. The 2012 Form W-2 will not be available for reprint until early February.

To obtain duplicate forms, employees may also call the Accounting Help Desk at (866-974-2733) and provide the following information:

n Employee name.

n Current mailing address.

n Social Security number and/or Employee ID.

n Name of office where employed (or previously employed, if not a current Postal Service employee).

n Year(s) requested.

If unsuccessful requesting duplicate Forms W-2 from the Accounting Help Desk or Employee Self Service, you may make a written request(s) to: Financial Reporting Section (W-2), Eagan Accounting Services, 2825 Lone Oak Parkway, Eagan MN 55121-9617. Requests must include the employee’s signature.

Eagan Accounting Services does not retain W-2 records older than seven years. In order to obtain records older than seven years, you need to write to the following address:

National Personnel Records Center, Annex

1411 Boulder Boulevard

Valmeyer, IL 62295

Fax: 618-935-3014

All requests must include the following:

n Requested tax years.

n Your name.

n Date of birth.

n Social Security number.

n Name and location of employing Federal agency.

n Beginning and ending dates of Federal service.

n Current mailing address.

n Signature (signed in cursive and dated within the last year).

Form W-2c is used by the Postal Service to correct a previously filed Form W-2. The Form W-2c will only report the corrections and should be used in conjunction with the original Form W-2 issued when filing taxes and/or other related information.

All requests for a corrected Form W-2c must be submitted in writing. All requests must include the following:

n Employee name.

n Current mailing address.

n Social Security number and/or Employee ID.

n Name of office where employed (or previously employed, if not a current Postal Service employee).

n Year(s) requested.

n Reason for request.

n Employee’s signature.

All requests for a duplicate Form W-2c must be submitted in writing. All requests must include the following:

n Employee name.

n Current mailing address.

n Social Security number and/or Employee ID.

n Name of office where employed (or previously employed, if not a current Postal Service employee).

n Year(s) requested.

n Employee’s signature.

Depending on your specific circumstances, up to three different IRS Forms 1099 may be issued to you:

n IRS Form 1099-MISC, Statement for Recipient of Miscellaneous Income.

n IRS Form 1099-R, Statement for Recipient of Distributions from Pensions, Annuities, Retirement, or Profit Sharing Plans, IRAs, Insurance Contracts, etc.

n IRS Form 1099-INT, Statement for Recipient of Interest Income.

This form originates from Accounting Services. View the Payer name and address in the left hand corner to determine appropriate office. Determine the nature of the payments and contact the appropriate Accounting Services group.

Eagan, MN (Payer name and address in left hand corner of Form 1099-MISC)

Requests for duplicate copies and questions regarding…

|

Should be directed to…

|

Payments to the beneficiaries of deceased employees of the unpaid compensation due at the time of death. Provide name, SSN and/or Employee ID, and date of death.

|

Financial Processing Section

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9616

|

Lump sum payments with no deductions as the result of settlements. Provide name, SSN and/or Employee ID, date of settlement, type of settlement, amount of settlement, period involved, and the date it was sent to the Accounting Services Center for payment.

|

Financial Processing Section

Eagan Accounting Services

2825 Lone Oak Parkway

Eagan, MN 55121-9616

|

St. Louis, MO (Payer name and address in left hand corner of Form 1099-MISC)

Both Office of Personnel Management (OPM) and Eagan Accounting Services mail Forms 1099-R. The Eagan Accounting Services office issues a Form 1099-R for annuity protection checks, and OPM issues a Form 1099-R for monthly annuity checks. The originating agency should be listed on the Form 1099-R. Determine which agency made the payments before making an inquiry.

This form originates from Accounting Services. View the Payer name and address in the left hand corner to determine appropriate office. Determine the nature of the payments and contact the appropriate Accounting Services group.

Eagan, MN (Payer name and address in left hand corner of Form 1099-INT)

St. Louis, MO (Payer name and address in left hand corner of Form 1099-INT)

— Payroll,

Controller, 1-10-13

W2, page 1

W2, page 1

W2 page 2

W2 page 2