The 2019 Christmas period for rural carriers begins Saturday, December 7, 2019 (Week 1, Pay Period (PP) 26–2019), and ends Friday, December 27, 2019 (Week 1, Pay Period 01-2020). During this period, certain timekeeping and pay rules apply. Timekeepers, including postmasters, supervisors, and other employees responsible for rural carrier time and attendance recording, must become familiar with Article 9.2.K., Christmas Allowances and Procedures, of the 2018–2021 USPS/National Rural Letter Carriers’ Association (NRLCA) Agreement.

This article describes:

n Types of compensation to which rural carriers are entitled during the Christmas period.

n Related timekeeping procedures and regulations for the Christmas period.

n Special rules that begin with the start of the Guarantee Year (October 12, 2019) and continue through the end of the Christmas period (December 27, 2019).

The preferred method of timekeeping data entry is through the Rural Management Support System (RMSS) web application. The following information provides USPS® guidelines for Rural Carrier compensation during the designated Christmas period:

We included exhibits to help you complete the following:

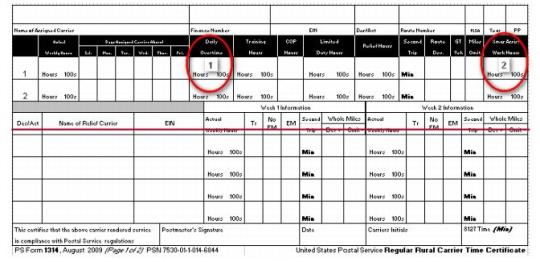

n PS Form 1314, Regular Rural Carrier Time Certificate, and

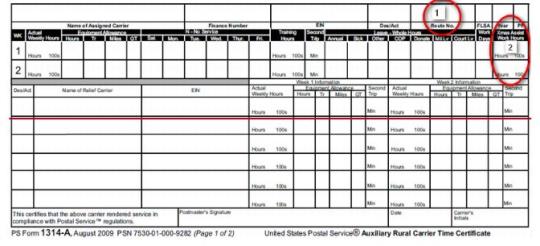

n PS Form 1314-A, Auxiliary Rural Carrier Time Certificate.

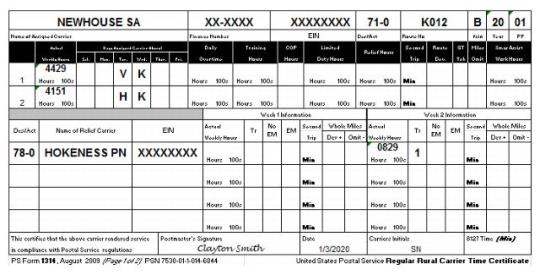

Exhibit 1 — Regular Carrier Works in Excess of Route’s Evaluation

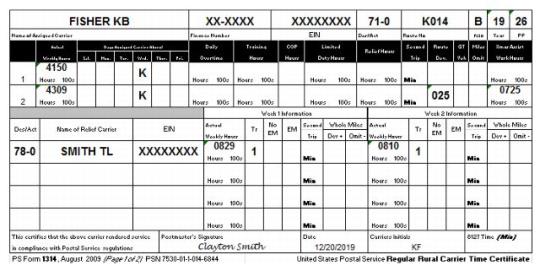

Exhibit 2 — Regular Carrier Not on Relief Day Work List Works Relief Day (Week 2) and Does Not Receive an X Day in the Same Pay Period

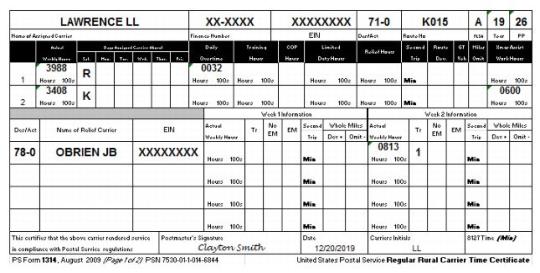

Exhibit 3 — Regular Carrier Works Designated Holiday

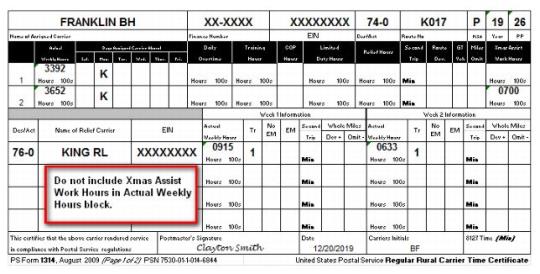

Exhibit 4 — Regular Carrier Provides Christmas Assistance

Exhibit 5 — FLSA Code A Regular Carrier

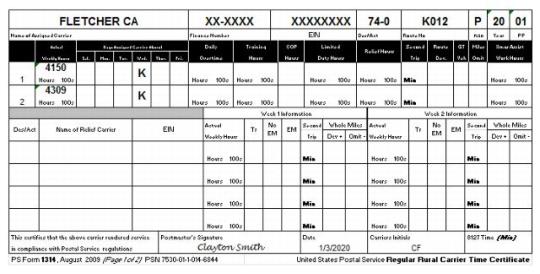

Exhibit 6 — Designation 74 Works Designated Holiday

Exhibit 7 — Designation 74 Provides Christmas Assistance on Relief Day

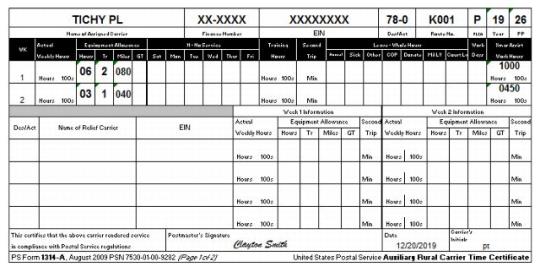

Exhibit 8 — Replacement Carrier Provides Christmas Assistance on a Regular Route

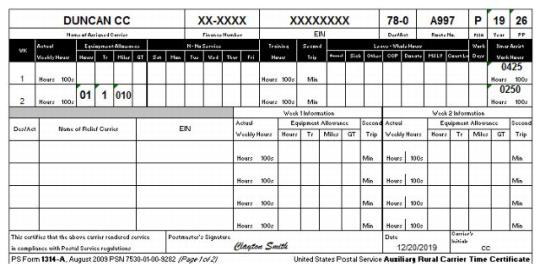

Exhibit 9 — Replacement Carrier Provides Christmas Assistance on an Auxiliary Route

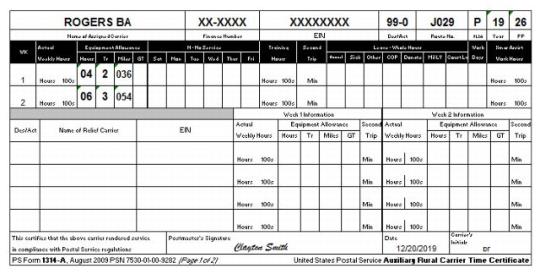

Exhibit 10 — Nonrural Employee Provides Christmas Assistance on Rural Route (EMA Only)

Exhibit 11 — Designation 79 Provides Christmas Assistance on Assigned Auxiliary Route

Exhibit 12 — RCA Provides Auxiliary Assistance and Christmas Assistance on an Auxiliary Route

Types of Overtime

During the Christmas period, regular rural carriers are eligible for two types of overtime — FLSA overtime and Christmas overtime.

FLSA Overtime

FLSA overtime is paid at all times of the year, not just during the Christmas period. Regular rural carriers are paid FLSA overtime under two circumstances:

a. Hours worked in excess of 12 hours in a day. If a carrier works more than 12 hours in a day, the amount over 12 is entered in the Daily Overtime block on PS Form 1314.

b. Hours worked in excess of 56 in a week. These hours are calculated automatically when the total weekly work hours are greater than 56, so no separate entries are required.

Christmas Overtime

Christmas Overtime is paid only during the designated Christmas period. Regular rural carriers are paid Christmas overtime under two circumstances:

a. Christmas Assistance — This is assistance provided by the regular carrier on his or her relief day. Christmas assistance work hours are entered in the Xmas Assist Work Hours block on PS Form 1314.

b. Hours worked in excess of the route’s evaluation — This is based on the total actual work hours for the week, not on individual days. For example, if a route has a daily evaluation of 9 hours and the regular carrier works 10 hours on 2 days, and 8 hours on the other 3 days, no overtime would be paid. Even though the carrier exceeded the daily evaluation on 2 days of the week, he or she did not exceed the weekly evaluation. The weekly evaluation is 45 hours; the carrier worked 44 hours. (See Handbook F-21, section 567, for overtime calculation when leave days are taken during the week and for routes with an evaluation of less than 40 hours.) These hours are calculated automatically, so no separate entries or calculations are required.

Overtime Rate

The overtime rate paid to regular (FLSA Code B) carriers is 150 percent of the carrier’s regular rate. The regular rate is determined by dividing the total compensation received for hours actually worked by the carrier since the beginning of the Guarantee Year (not including overtime), by the total number of hours worked since the beginning of the Guarantee Year (not including overtime). This overtime rate is used for both FLSA overtime and Christmas overtime.

Replacement Carriers (Designations 70, 73, 74, 75, 76, 77, 78, and 79) are only entitled to FLSA overtime. For these employees, FLSA overtime is paid for hours worked in excess of 40 in a week.

Regular carriers whose FLSA code is A are paid for actual hours worked, not evaluated hours. They are paid overtime for hours in excess of 8 in a day or 40 in a week. For FLSA Code A carriers, enter hours in excess of 8 in a day to the Daily Overtime block on PS Form 1314. Hours in excess of 40 in a week are calculated automatically.

Carriers serving any auxiliary route are compensated at the hourly rate for actual hours worked during PP 26-2019 and Week 1 of PP 01-2020. During this period, carriers are not paid the evaluation of the route. Overtime is paid only when the carrier exceeds 40 hours for the week.

Christmas assistance is additional service provided on a rural route during the Christmas period. For regular carriers, Christmas assistance applies only to assistance given by the carrier, on his or her relief day, while a replacement carrier is assigned to work the full route. For replacement carriers, it applies to any assistance provided on a regular or auxiliary route during the Christmas period. Christmas assistance is reported in the Xmas Assist Work Hours block on PS Form 1314 (for regular carriers) or PS Form 1314-A (for replacement carriers).

Regular carriers can perform Christmas assistance only on their relief day. Therefore, only regular carriers assigned to J or K routes may report Christmas assistance. Regular carriers assigned to route types H or M cannot perform Christmas assistance because these route types do not have a relief day. Note: There are no provisions for paying a regular carrier for performing service on a Sunday, on an actual holiday, or other than on the assigned route. These situations must be avoided.

n A regular carrier comes in on his or her relief day and helps the replacement carrier case the route.

n A regular carrier comes in on his or her relief day and carries part of his or her regular route. (Replacement carrier is listed on PS Form 1314.)

n A replacement carrier carries part of a regular route due to heavy Christmas volume.

These are NOT examples of Christmas assistance:

n A regular carrier comes in on his or her relief day and cases and carries his or her regular route.

n A regular carrier works 2 hours beyond the daily evaluation of his or her regular route.

n A regular carrier performs any work while assigned to an H or M route.

1. Daily Overtime — For FLSA B carriers, this block is used ONLY to record when the carrier works more than 12.00 hours in a single day. (See Exhibit 4 for use of this block for FLSA Code A regular carriers. This block is not used for FLSA Code P.) Record the total amount of work hours in excess of 12 per day in this box. Include the amount of daily overtime in the Actual Weekly Hours block. For example, if the carrier works 10.00 hours each day, Monday through Wednesday, and works 12.50 on Thursday and 13.00 on Friday, the amount entered into the Daily Overtime block is 1.50 and the amount entered into the Actual Weekly Hours is 55.50. Do not enter a decimal point when entering work hours.

The Daily Overtime block is NOT used to record:

n Hours worked in excess of 56 in a week.

n Hours worked in excess of the route’s evaluation.

n Hours worked when the carrier works his or her relief day.

n Additional hours worked by the carrier after completing his or her route (except for those that are over 12 hours for the day).

2. Xmas Assist Work Hours — For FLSA Code B regular carriers, this block is used ONLY when the carrier comes in on his or her relief day to provide assistance, not to serve his or her full route. A relief carrier must be listed on PS Form 1314 as the replacement carrier for that day. Do NOT include the amount of Xmas Assist Work Hours in the Actual Weekly Hours block.

The Xmas Assist Work Hours block is NOT used to record:

n Hours worked in excess of 56 in a week.

n Hours worked in excess of the route’s evaluation.

n Hours worked when the carrier works his or her relief day and DACA Code R, 3, or 5 is entered on the PS Form 1314.

n Additional hours worked by the carrier after completing his or her route.

1. Route No. — Use the chart below to determine which route number to enter on the PS Form 1314-A when reporting Christmas assistance by replacement carriers or on auxiliary routes.

2. Xmas Assist Work Hours — This block is used whenever a replacement carrier provides Christmas assistance. Do not include the amount of Xmas Assist Work Hours in the Actual Weekly Hours block.

During the period from the beginning of the Guarantee Year (October 12, 2019), through the last day of the Christmas period (December 27, 2019) — which includes pay periods 22-2019, 23-2019, 24-2019, 25-2019, 26-2019, and 01-2020 (Week 1) — record relief days worked by regular rural carriers on PS Form 1314, as described below.

1. Carriers who work a relief day during this period and who are entitled to a future day off (X day) must be given that X day in the same pay period. Record DACA Code R or 3 on PS Form 1314 for the relief day that is worked, and DACA Code X on the day that is taken off. The Rural Time and Attendance Collection System (RTACS) will not accept any PS Form 1314 that contains a DACA Code 3 or DACA Code R without a corresponding DACA Code X.

2. Record DACA Code 5 on PS Form 1314 for the relief day that is worked if an X day is not taken in the same pay period that the relief day is worked, or if the carrier is on the relief day work list and selects the option for 150 percent compensation. When DACA Code 5 is entered, the carrier does not receive an X day.

3. Carriers may not use any X days that were earned in previous pay periods during this period. RTACS will not accept any PS Form 1314 that contains a DACA Code X without a corresponding DACA Code 3 or DACA Code R.

4. Carriers must have a sufficient balance of X days available in order to use an X day. Carriers with a negative X day balance cannot use any X days until the negative balance is erased.

A. FLSA B Regular Rural Carriers

1. Work on Relief Day — Only regular carriers on J or K routes have an assigned relief day. Any work performed by a regular on his or her relief day must be reported in one of the following ways:

a. Regular carries entire route — If the carrier reports on the relief day and cases and carries the assigned route (as is done on a scheduled day), enter DACA Code R, 3, or 5 (as appropriate) on PS Form 1314 for that day. If the carrier is due an X day for working the relief day (e.g., DACA Code R or 3 is entered), this X day must be granted in the same pay period. If the X day is not granted within the same pay period, DACA Code 5 must be entered on PS Form 1314.

b. Christmas assistance — If a relief carrier serves the assigned route and the regular carrier provides assistance on the relief day, record the hours worked by the regular as Xmas Assist Work Hours. If additional Equipment Maintenance Allowance (EMA) is due for work performed on the relief day, enter the mileage traveled in whole miles in the Route Deviation block for the appropriate week.

B. FLSA Code A Regular Carriers

Regular carriers (FLSA Code A) are paid at the regular rate for all hours worked up to 8 per day and 40 per week, and at the overtime rate for all hours worked in excess of 8 per day or 40 per week. FLSA Code A employees are not entitled to any X days as they are paid for working the relief day.

1. Report total hours worked for the week in Actual Weekly Hours.

2. If the carrier worked more than 8.00 hours in a day, enter total hours worked in excess of 8 for that day in the Daily Overtime block.

3. If the carrier worked on a scheduled relief day, enter R on the day the carrier worked the relief day and include the hours worked in Actual Weekly Hours. The employee is NOT entitled to a future X Day.

C. Auxiliary Route Carriers

Carriers serving any auxiliary route are compensated at the hourly rate for actual hours worked during PP 26-2019 and Week 1 of PP 01-2020. During this period, carriers are not paid the evaluation of the route (this includes newly hired RCAs in the first five pay periods of training). The only changes to standard timekeeping procedures for auxiliary routes are when a Designation (Des) 79 provides Christmas assistance on the assigned auxiliary route. (See section E, item 2).

D. Replacement Carriers Assigned to Vacant Regular Routes (Designations 72/74)

1. Designation 72

a. FLSA B — Procedures are the same as for Des 71 (Regular Carrier), FLSA B.

b. FLSA A — Procedures are the same as for Des 71 (Regular Carrier), FLSA A.

2. Designation 74

Work on relief day

a. Carrier worked scheduled relief day:

(1) Enter R on the day the carrier worked the relief day.

(2) Include the hours worked in the Actual Weekly Hours. The employee is NOT entitled to a future X Day.

b. Carrier provided Christmas assistance on relief day:

(1) Enter the Christmas auxiliary assistance time on PS Form 1314 in the Xmas Assist Work Hours block.

(2) Do NOT include these hours in the Actual Weekly Hours block.

(3) Enter J or K in the appropriate block on PS Form 1314 if the replacement carrier worked a full day on the route.

E. Replacement Rural Carriers Serving as Christmas Auxiliary Assistants

All replacement carriers serving as Christmas auxiliary assistants are compensated at their regular rate for actual hours worked up to 40 per week, and at the FLSA overtime rate for actual hours worked in excess of 40.

1. Christmas assistance on a regular route:

a. Manually prepare PS Form 1314-A for each carrier that provides Christmas assistance.

b. Do NOT enter more than one carrier on each PS Form 1314-A.

c. Submit a separate certificate for each regular route on which the carrier provides assistance.

d. Report the Christmas assistance hours in the appropriate Week 1 and/or Week 2 Xmas Assist Work Hours block.

e. Enter EMA hours, trips, and miles in the appropriate Week 1 and/or Week 2 EMA blocks.

2. Christmas assistance on an auxiliary route:

a. Assigned carrier (Des 79) provided Christmas assistance on assigned auxiliary route:

(1) Enter N in the appropriate block in the

No Service section of the carrier’s PS Form 1314-A for the assigned route.

(2) Record hours worked in the Xmas Assist Work Hours block. Only enter Christmas assistance when the Des 79 assists the replacement carrier working the N day.

(3) Include EMA hours and miles (not trips) in the total for the appropriate week. Trips may not exceed the number of days worked in the No Service blocks.

(4) A replacement carrier is required to crossfoot the card.

b. Replacement carrier (Designations 70, 73, 74, 75, 76, and 78) provided Christmas assistance on auxiliary route:

(1) Manually prepare PS Form 1314-A. Enter route number A997. Use this route type and number for overburdened service or Christmas assistance on auxiliary routes only.

(2) Report the Christmas assistance hours in the appropriate Week 1 and/or Week 2 Xmas Assist Work Hours block.

(3) Enter EMA hours, trips, and miles (if applicable) in the appropriate Week 1 and/or Week 2 EMA blocks.

(4) If Christmas assistance is performed on two or more auxiliary routes in the same pay period, combine all work hours and EMA data on one manually prepared PS Form 1314-A.

F. Postal Employees (Other Than Rural) Serving as Christmas Auxiliary Assistants

Postal Service employees (other than Des 7X) who provide Christmas assistance on rural routes are compensated at their regular rate of pay for actual time worked. Include all work hours using their normal Time and Attendance System (Manual Timecards or TACS).

Nonrural employees are entitled to EMA payment if a personal vehicle is used. Prepare PS Form 1314-A as follows: (Do NOT prepare PS Form 1314-A if a government vehicle is provided.)

1. Report the hours worked on the rural routes on PS Form 1230-C, Time Card.

2. Manually prepare PS Form 1314-A for EMA compensation. Complete indicative data at the top of the certificate. Use Des/Act 99-0, actual route type and number, FLSA code P, and correct employee and pay period information.

3. Enter EMA hours, trips, and miles in the appropriate Week 1 and/or Week 2 EMA blocks.

n Hours entered in the Daily Overtime block are always included in Actual Weekly Hours.

n Hours entered in the Xmas Assist Work Hours block are NOT included in Actual Weekly Hours.

n Carriers on auxiliary routes are paid for actual hours worked, not the route’s evaluation, during the Christmas period.

n During the period from the beginning of the Guarantee Year (October 12, 2019) through the last day of the Christmas period (December 27, 2019), a DACA Code X cannot be entered on a timecard unless there is a corresponding DACA Code R or 3 in the same pay period and the carrier’s X day balance is zero or greater.

n DACA R and 3 require a DACA Code X to be used in the same pay period.

n If Actual Weekly Hours exceed 56 hours in a week, a DACA Code 5 must be used. DACA Code 3 or R are not allowed.

n If a regular carrier works his or her relief day and serves his or her assigned route, this is NOT reported as Christmas assistance.

n Regular carriers may only work on their assigned route.

n Second trip is not allowed during the Christmas period.

1. A regular carrier is assigned to a 45-hour evaluated route (Daily evaluation = 9.00 hours).

2. The carrier works 45.08 hours in Week 1 and 38.08 hours in Week 2 as follows:

3. Carrier will be paid Christmas overtime for 0.08 hours in Week 1 and 2.08 hours in Week 2 based on hours worked over the route’s evaluated hours. A day of paid leave will count as one day’s evaluation in calculating Christmas overtime. A day of unpaid leave will count as zero.

4. No manual computation for Christmas overtime is necessary. This is automatically computed. No entries are made into the Daily Overtime block.

1. A regular carrier is required to work the second relief day of Pay Period 26. The carrier initially selects the option to receive a future X day (DACA 3). However, the carrier does not get an X day in the same pay period.

2. Enter DACA Code 5 on the relief day (Saturday) of Week 2.

3. The carrier is paid 150 percent of one day’s evaluation for working the relief day and does not receive a future X day.

1. A regular carrier’s relief day is Wednesday. The carrier works the designated holiday on Tuesday, December 24.

2. Enter V on Tuesday of Week 1.

3. Include hours worked on the designated holiday in the Actual Weekly Hours block.

4. The carrier is not entitled to an X day for working the holiday.

5. Do NOT enter Holiday work hours in the Daily Overtime block.

6. The carrier will receive 150 percent of one day’s evaluation for working the designated Christmas holiday. Note: Regular rural carriers cannot work on actual holidays, such as Wednesday, December 25 or Wednesday, January 1.

1. A carrier works 7.25 hours of Christmas assistance on the relief day Wednesday, Week 2, and uses a personal vehicle for 25 miles.

2. Enter 0725 hours in Xmas Assist Work Hours. Do NOT include these hours in the total work hours for the week on PS Form 1314.

3. Enter the 25 miles traveled on the relief day in whole miles in the Route Deviation block.

4. No manual computation for Christmas overtime is necessary. This is automatically computed. Do NOT enter Christmas assistance in the Daily Overtime block.

1. A regular carrier whose FLSA code is A is paid by the hour. Overtime is paid for all hours over 8 in a day or 40 in a week.

2. The carrier works 8.32 hours on Tuesday of Week 1. Enter 0032 hours in the Daily Overtime block.

3. The carrier works relief day (Saturday) in Week 1. Enter DACA Code R on Saturday, Week 1. Include these hours in Actual Weekly Hours. The carrier is paid for these hours, so no X day is due.

4. The carrier works 39.88 total hours in Week 1.

5. The carrier works Christmas assistance (6 hrs.) on the relief day on the second Saturday. Record the Christmas assistance time in the Xmas Assist Work Hours block. Do NOT add these hours to the Actual Weekly Hours. Overtime will only be paid if the carrier exceeds 40 hours for the week.

6. No manual computation for Christmas overtime is necessary. This is automatically computed. The carrier will receive 0.32 hours of overtime in Week 1 and 0.08 hours of overtime (34.08 + 06.00 = 40.08 hours) in Week 2.

1. A rural carrier associate is assigned to a vacant K route, with the relief days on Wednesdays.

2. The carrier works both designated holidays on Tuesday, December 24 and Tuesday, December 31.

3. Do not enter V or H for working the designated holidays. Designation 74s are not entitled to holiday leave pay. Tuesdays are a regular work day.

4. Include hours worked on Tuesdays in the Actual Weekly Hours block.

5. A replacement carrier is not needed to crossfoot the card for either weeks.

1. The RCA is assigned to a vacant regular K route with a relief day of Monday.

2. On the second Monday, the Des 74 carrier provides Christmas assistance for 7 hours. The replacement carrier works the route the entire day.

3. Enter K for the second Monday.

4. Enter 0700 hours in the Xmas Assist Work Hours block. Do NOT include these hours in the Actual Weekly Hours block.

5. The carrier will be paid 3.52 hours overtime (36.52 + 7.00 = 43.52).

6. Enter appropriate information for the relief carrier in the bottom section of the time certificate.

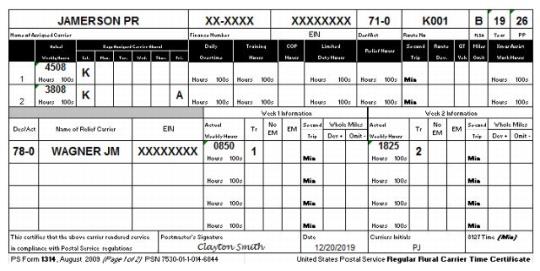

1. A regular carrier on Route K001 carries his or her route on regularly scheduled day.

2. A replacement carrier provides Christmas assistance on Route K001 for 3.25 hours on Tuesday, Week 1; 6.75 hours on Friday, Week 1; and 4.50 hours on Saturday, Week 2.

3. On each of these days, the replacement carrier spends 3 hours on the street and travels 40 miles each day (in his or her own vehicle).

4. Prepare PS Form 1314-A using the actual route number (K001) on which service was performed.

5. Enter 1000 hours in the Xmas Assist Work Hours block for Week 1 and 0450 hours for Week 2. Do NOT include these hours in Actual Weekly Hours.

6. Enter EMA data in the appropriate Equipment Allowance blocks.

7. Do not enter any information on the bottom (relief carrier) section of the card.

8. If the replacement carrier provides Christmas assistance on more than one regular route, complete a separate PS Form 1314-A for each route on which Christmas assistance is provided.

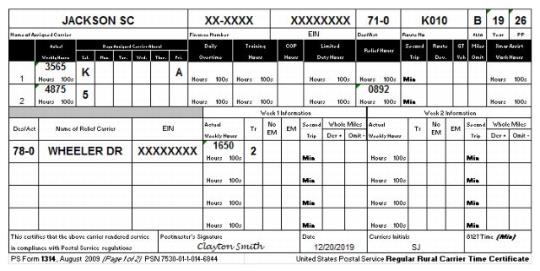

1. A replacement carrier provides 3.00 hours Christmas assistance on Route A003 on Monday, Week 1; 1.25 hours of Christmas assistance on Route A009 on Wednesday, Week 1; and 2.50 hours Christmas assistance on Route A003 on Saturday, Week 2. All hours are worked in the office, except one hour on the street on Saturday, Week 2 (10 miles).

2. Prepare one PS Form 1314-A using route number A997 for all Christmas assistance hours on auxiliary routes.

3. Enter hours worked in the Xmas Assist Work Hours block. Do NOT include these hours in Actual Weekly Hours.

4. Enter EMA data in the appropriate Equipment Allowance blocks.

1. A clerk works as a Christmas auxiliary assistant on Route J029 and provides his or her own vehicle.

2. Complete PS Form 1314-A using Des 99-0 and the route number of the regular route. (Use A997 if assistance is provided on an auxiliary route.)

3. Enter the hours, trips, and miles in the Equipment Allowance blocks.

4. Do NOT enter any Actual Weekly Hours or Xmas Assist Work Hours. Work hours for nonrural employees are paid using their regular timekeeping system (e.g., manual timecards, TACS).

5. If Christmas assistance is provided on more than one regular route, complete a separate PS Form 1314-A for each employee and for each route on which they provide Christmas assistance.

6. If Christmas assistance is provided on more than one auxiliary route, combine the EMA data and enter the totals on one PS Form 1314-A using route number A997.

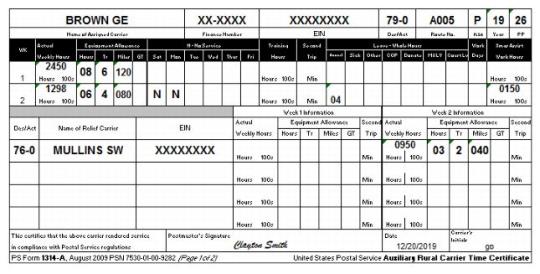

1. A Des 79 assigned to route A005 served a regular route on Saturday, Week 2, while another replacement carrier worked on Saturday. Enter an N in the No Service block.

2. The Des 79 provided 1.5 hours Christmas Assistance on route A005 on Saturday, Week 2.

3. The Des 79 took 4 hours of annual leave on Monday, Week 2.

4. Enter hours worked (0150) in the Xmas Assist Work Hours block. Do NOT include these hours in Actual Weekly Hours.

5. Enter the replacement carrier that served route A005 on Saturday and Monday on the bottom of PS Form 1314-A.

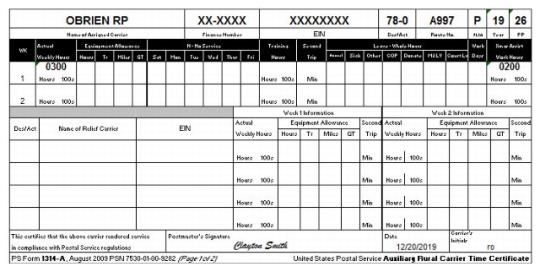

1. A replacement carrier provides 3.00 hours Auxiliary assistance on Route A003 on Monday, Week 1, and 2.00 hours Christmas assistance on Route A009 on Wednesday, Week 1. All hours are worked in the office.

2. Prepare one PS Form 1314-A using route number A997 for all Auxiliary and Christmas assistance hours on auxiliary routes.

3. Enter hours worked (3.00) as Auxiliary assistance in the Actual Weekly Hours block.

4. Enter hours worked (2.00) as Christmas assistance in the Xmas Assist Work Hours block. Do NOT include in Actual Weekly Hours.

5. This timecard would result in 05.00 hours of pay.

— Payroll, Controller, 10-24-19