|

|

From acceptance to delivery, we’re focused on enhancing our operational performance and increasing customer value. At the same time, we’re preparing to meet future customer needs.

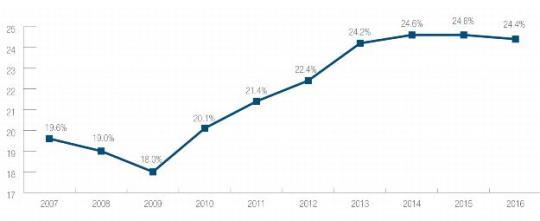

Total Factor Productivity (TFP) – TFP is an index that measures how efficiently the Postal Service uses resources (inputs) to handle all aspects of our workload. An increase in the TFP index indicates that the ratio of work being completed is increasing compared to the resources used and that the Postal Service is operating more efficiently. Workload consists of three primary components: delivery points, mail volume weighted by product type and miscellaneous output (e.g., passports). Resource usage is based on the constant dollar amounts (i.e., the costs adjusted for changes in prices) of the labor, capital and materials used by the Postal Service.

Total Factor Productivity

(Cumulative improvements compared to 1972 baseline)

Note: Prior year results are updated based on most current data. All years shown are fiscal years.

Number of Routes, by Type of Delivery (see Delivery Optimization)

(in actual units indicated, unaudited)

Route

|

FY2016

|

FY2015

|

FY2014

|

FY2013

|

City

|

144,571

|

143,051

|

141,271

|

142,073

|

Rural

|

74,724

|

73,818

|

73,166

|

73,089

|

Highway contract route

|

9,809

|

9,908

|

9,928

|

9,990

|

Total

|

229,104

|

226,777

|

224,365

|

225,152

|

Postal Vehicle Inventory (see Investing in the Delivery Fleet)

(in actual units indicated, unaudited)

Vehicle type

|

FY2016

|

FY2015

|

FY2014

|

FY2013

|

Delivery and collection (½–2½ tons)

|

203,853

|

193,489

|

189,750

|

190,104

|

Mail transport (tractors and trailers)

|

5,511

|

5,620

|

5,751

|

5,850

|

Mail transport (3–9 tons)

|

2,100

|

2,112

|

2,133

|

2,139

|

Administrative and other

|

6,357

|

6,414

|

6,249

|

6,449

|

Service (maintenance)

|

7,191

|

4,565

|

4,599

|

4,613

|

Inspection Service and law enforcement

|

2,884

|

2,733

|

2,782

|

2,529

|

Total

|

227,896

|

214,933

|

211,264

|

211,684

|

Real Estate Inventory (see Facilities Management)

(in actual units indicated, unaudited)

Real estate inventory

|

FY2016

|

FY2015

|

FY2014

|

FY2013

|

Owned properties

|

8,484

|

8,524

|

8,583

|

8,598

|

Owned interior square feet

|

192,521,396

|

194,220,092

|

195,617,292

|

196,956,774

|

Leased properties

|

23,214

|

23,314

|

23,649

|

23,814

|

Leased interior square feet

|

78,735,195

|

78,144,453

|

77,838,427

|

79,045,620

|

GSA/other government properties

|

285

|

286

|

296

|

297

|

GSA/other government interior square feet

|

1,885,956

|

1,902,726

|

2,001,667

|

2,005,330

|

Real Estate Inventory Actions (see Facilities Management)

(in actual units indicated, unaudited)

Inventory actions

|

FY2016

|

FY2015

|

FY2014

|

FY2013

|

Lease actions (alternate quarters, new leases and renewals)

|

5,050

|

6,206

|

5,282

|

3,487

|

Property disposals1

|

27

|

16

|

30

|

44

|

New construction (AQ, NCL, NCO and expansion)2

|

52

|

22

|

70

|

29

|

Repair and alteration projects (expense)

|

53,466

|

51,584

|

46,961

|

45,040

|

Repair and alteration expense totals

|

$ 245,000,000

|

$ 215,000,000

|

$ 159,000,000

|

$ 156,000,000

|

Repair and alteration projects (capital)

|

5,102

|

6,981

|

6,431

|

4,178

|

Repair and alteration capital totals

|

$ 314,000,000

|

$ 347,000,000

|

$ 226,000,000

|

$ 195,000,000

|

The Total Factor Productivity chart starts with the cumulative TFP improvement from 1972 to 2007 and then reflects the cumulative score each year since then. TFP declined slightly in FY2016. Labor productivity was positive as the weighted mail volume growth was higher than the labor resources used, however this was outweighed by the additional transportation used to improve service.

Delivery Optimization – With the exception of packages, mail volume continues to decline over time while the number of addresses we deliver to steadily increases. Because of this, there’s a need to continuously revamp the delivery infrastructure through route reviews and adjustments, focus on increasing centralized delivery and use technology to leverage comprehensive delivery applications. This includes the delivery management system and volume arrival profile. Local Operations Centers (LOCs) were deployed in every area and district office to improve delivery and customer service by providing real-time insight into street delivery operations. These LOCs are being used to monitor and mitigate daily delivery unit conditions with possible customer service impacts.

In the past year, the Postal Service completed the deployment of over 276,000 Mobile Delivery Devices (MDDs) to 24,666 delivery units in 19,472 postal facilities. The MDD with its innovative functionalities improves the Postal Service’s ability to provide customers with real-time scanning and predictive delivery. MDD deployment provides new functionalities to all of USPS delivery routes including 144,000-plus city routes and over 74,000 rural routes.

Mode Conversions – The Postal Service continues to provide consistent and reliable service in an efficient manner by converting deliveries to a more centralized mode. Mode conversions also enable the Postal Service to reduce transportation costs. As a result of our communication and outreach efforts with our customers, in FY2016, the Postal Service achieved a total of 98,439 voluntary conversions: 74,227 residential conversions and 24,212 business conversions.

Route Evaluations and Adjustments – Field management continues to inspect, evaluate and adjust delivery routes as necessary to control costs while improving service. During FY2016, the total number of routes increased by 2,327 from 226,777 to 229,104, while growing 1,142,352 additional delivery points.

Investing in the Delivery Fleet – In FY2016, the Postal Service invested $221.7 million in our delivery fleet. This includes 3,339 RAM ProMaster extended capacity delivery vehicles, purchased for $105.4 million to replace our aging fleet of 2006 minivans. We also purchased 2,446 service vehicles for $76.9 million replacing our vehicle maintenance vehicles with a mean age of 15.7 years. In addition, 1,688 administrative vehicles will be purchased for $39.4 million to replace administrative vehicles with a mean age of 12 years.

Network and Transportation Optimization – In FY2016, the Postal Service continued its self-imposed deferment on consolidations to focus on continued improvements to service performance. While improving service, the Postal Service also aligned its inventory of processing equipment to reflect the continuing changes in public mailing habits. By focusing on improvements in machine utilization and reducing fixed overhead costs, the Postal Service is operating with 6.1 percent fewer letter sorting machines or Delivery Bar Code Sorters (DBCS) than last fiscal year. The Postal Service continues to repurpose available processing space to support the growth in package processing, without the need to invest in new facility assets.

The continued use of Lean Principles and analytical tools has also resulted in a more balanced transportation network, better aligning carrier capacities with processing realities. The result of these improvements can be seen in the record service performance of Priority Mail and Standard mail.

Lean Mail Processing (LMP) – Mail processing facilities and delivery units nationwide, continue to build on LMP principles. Sites nationwide are now focusing on Customer to Customer Value Stream for different product types. They are identifying pain points in the value stream and utilizing Lean Six Sigma tools, to improve operational efficiency and reduce cycle times. Utilizing these tools help reduce waste and create an organized workspace with standardized roles and responsibilities. LMP principles will continue to use key performance indicators to drive improvements in mail processing operations, which result in better service for our customers and better budget outcomes for USPS.

Air Cargo Optimization – During FY2016, there was a significant focus on improving our air network modeling capability and accuracy. New modeling technology was deployed consisting of multiple models, one focused on forecasting future air demand and one dedicated to allocating the demand across the various air networks. The new allocation model increases the opportunity to use lower cost carrier capacity by maximizing the allocation of air demand to the appropriate air network based on service standards and contract terms.

Ground Transportation Optimization – Highway transportation expenses for FY2016 were $3.8 billion. This is an increase of 5 percent over FY2015. The increase resulted in large part due to package volume growth, strategically moving some lanes from Air-to-Surface, increase in rate per mile due to legislation in California as well as a nationwide shortage of drivers, and the expanded Peak Season ground network in FY2016 to handle package growth. These increased transportation costs were buffered by a reduction in fuel prices and our efficiency measures to remove redundant transportation from the network.

International Operations Optimization – The Postal Service continues to focus on improving customer service performance and reducing cost through increased visibility for international civilian, DOD (Military mail) and Department of State (DOS) volume using customs data to improve operational processes. In collaboration with DOD and DOS, the USPS has enabled enhanced customer visibility and tracking of Air/Army Post Office (APO), Fleet Post Office (FPO) and Diplomatic Post Office (DPO) mailpieces being dispatched to/from select high-volume locations: Europe, Middle East and Asia. USPS also continues to leverage additional scan events on outbound international civilian items by integrating air carrier data and additional foreign post scan events into its tracking platforms. USPS is piloting the “Green Lane” initiative at JFK Airport to expedite the customs processing of inbound packages using electronic customs declaration data so “targeted” volume is sent to customs and the balance of the volume “by-passes” customs and gets to the recipient sooner. Based on the results of the JFK pilot, the plan is to select an additional pilot location in early FY2017. The double-digit growth of inbound international e-commerce volume over the last four years is requiring a more aggressive strategy for the expansion of foreign post partners providing Advanced Electronic Data (AED) which will be the framework for future initiatives to expedite inbound international civilian and military sorting within the domestic network.

|

|